Why Cash Gets Poorer Over Time

Inflation quietly erodes savings and why investing is the only way to keep up.

In a recent interview, legendary investor Ron Baron explained something most people feel, but few truly understand about money and purchasing power. You can watch the clip here (around the 2:30 mark):

👉 Watch the video

Baron explains that:

Money loses 4–5% of purchasing power per year, while the economy grows about 2% annually — a combined erosion of roughly 7% per year.

Those numbers may sound abstract, but in real life they translate into something very real:

🕰 Prices double roughly every 10–12 years

💸 Savings lose half their value in about 15 years

🛟 Holding cash long-term is not “safe” — it’s a slow, guaranteed loss

This isn’t a short-term trend. It’s how modern economies are designed.

💡 Inflation Isn’t a Glitch — It’s a Feature of the System

Inflation exists for a reason. Our economic system is built to:

encourage spending and investment

reward productivity and innovation

keep money circulating in the economy

And by design… it quietly penalizes money that sits still.

That means:

Cash in a checking account keeps you stable — but not wealthy

Dollars saved today won’t buy the same amount in the future

“Safety” in cash can become risk in disguise

Saving is still important — especially for emergencies and short-term needs — but saving alone isn’t a wealth strategy.

📈 Why Investors Own Assets, Not Just Cash

Long-term wealth is created by owning productive assets that can grow alongside (or faster than) the economy:

businesses and equities

real estate

diversified investment portfolios

These assets benefit from:

earnings growth

innovation

productivity gains

compounding over time

Historically, these forces have helped investors outpace inflation, while uninvested cash falls behind.

The real financial risk isn’t volatility — it’s permanently losing purchasing power.

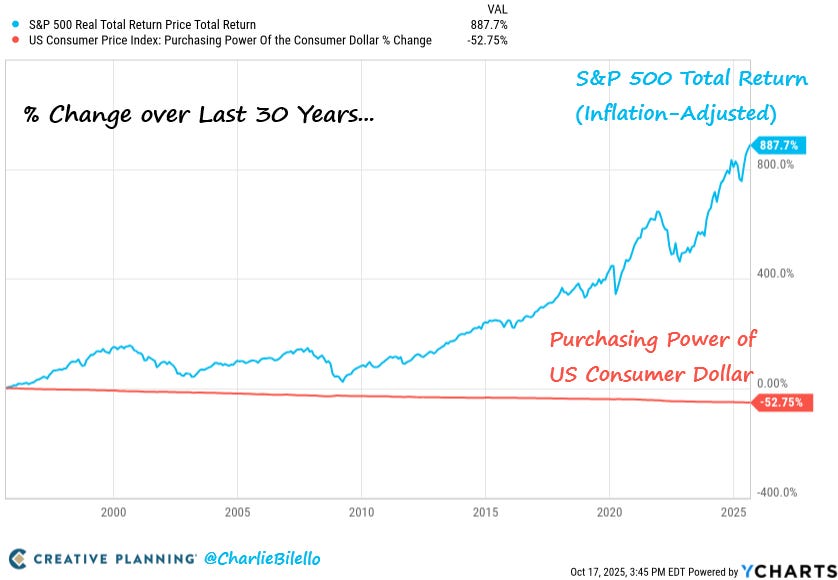

This is why you need to invest, in one chart…

Over the last 30 years, the purchasing power of the U.S. Consumer’s Dollar has been cut in half due to inflation and the S&P 500 has gained 888% (~8% per year) AFTER adjusting for inflation.

🧭 So What Should You Do?

This doesn’t mean you should invest every dollar.

Cash still has an important role:

emergency reserves

upcoming expenses

peace-of-mind liquidity

But beyond that, the goal is to put your money to work in a thoughtful, long-term plan — one aligned with your goals, timeline, and risk tolerance.

Because over long periods of time, the scoreboard is clear:

👉 Owners and investors tend to move forward.

👉 Idle cash slowly drifts backward.

Questions? Reach out to the Sandbox team and start the conversation today.

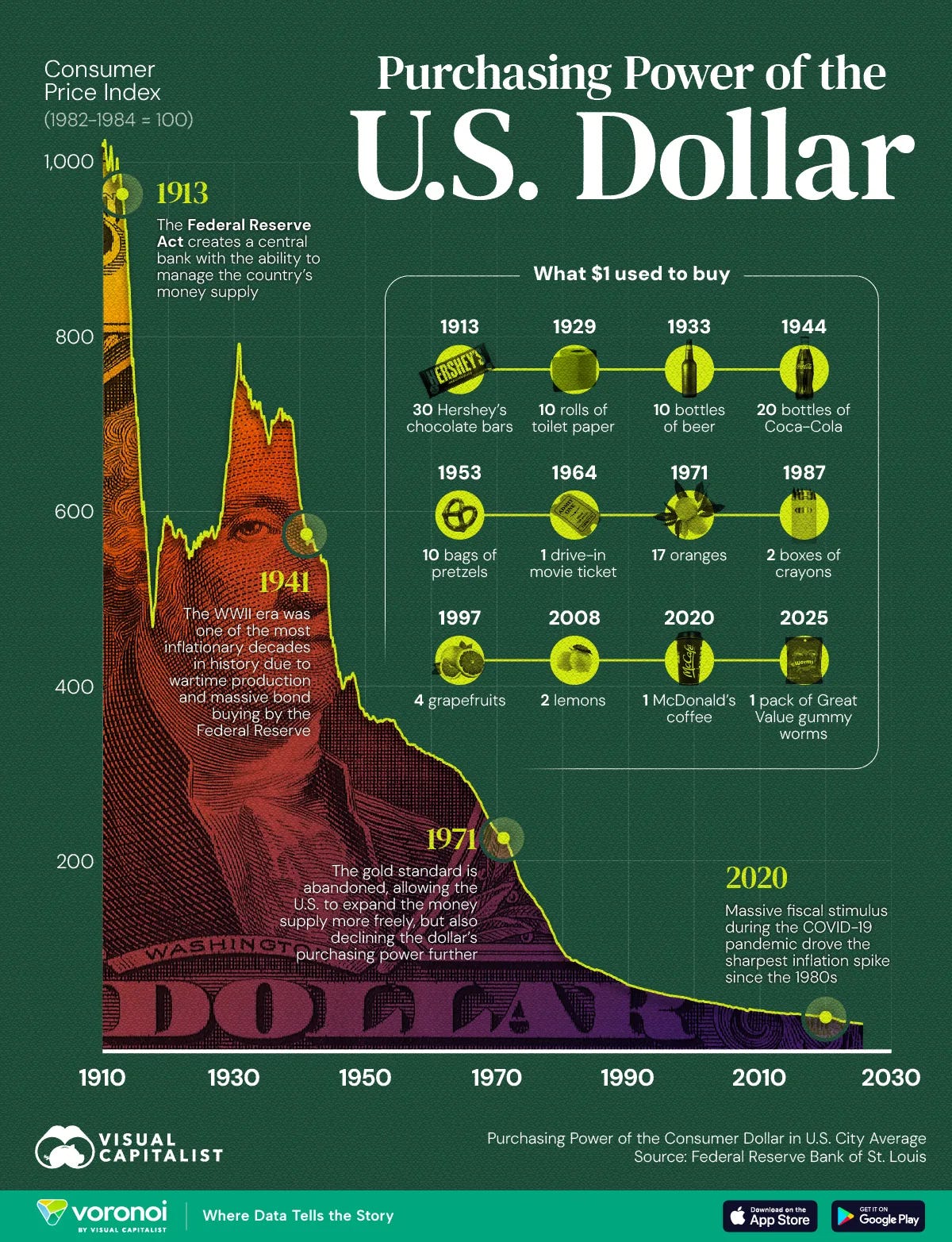

Purchasing Power of $1 since 1950:

1950: $1.00 had the buying power that $13.45 has today.

1975: $1.00 had the buying power that $6.02 has today.

2000: $1.00 had the buying power that $1.88 has today.

2025: $1.00 only buys what about 7 cents could buy in 1950.

Cash feels safe.

Time says otherwise.

If your money isn’t growing faster than inflation, you’re falling behind.