When Giants Outperform

Meta & Microsoft keep Raising the Bar

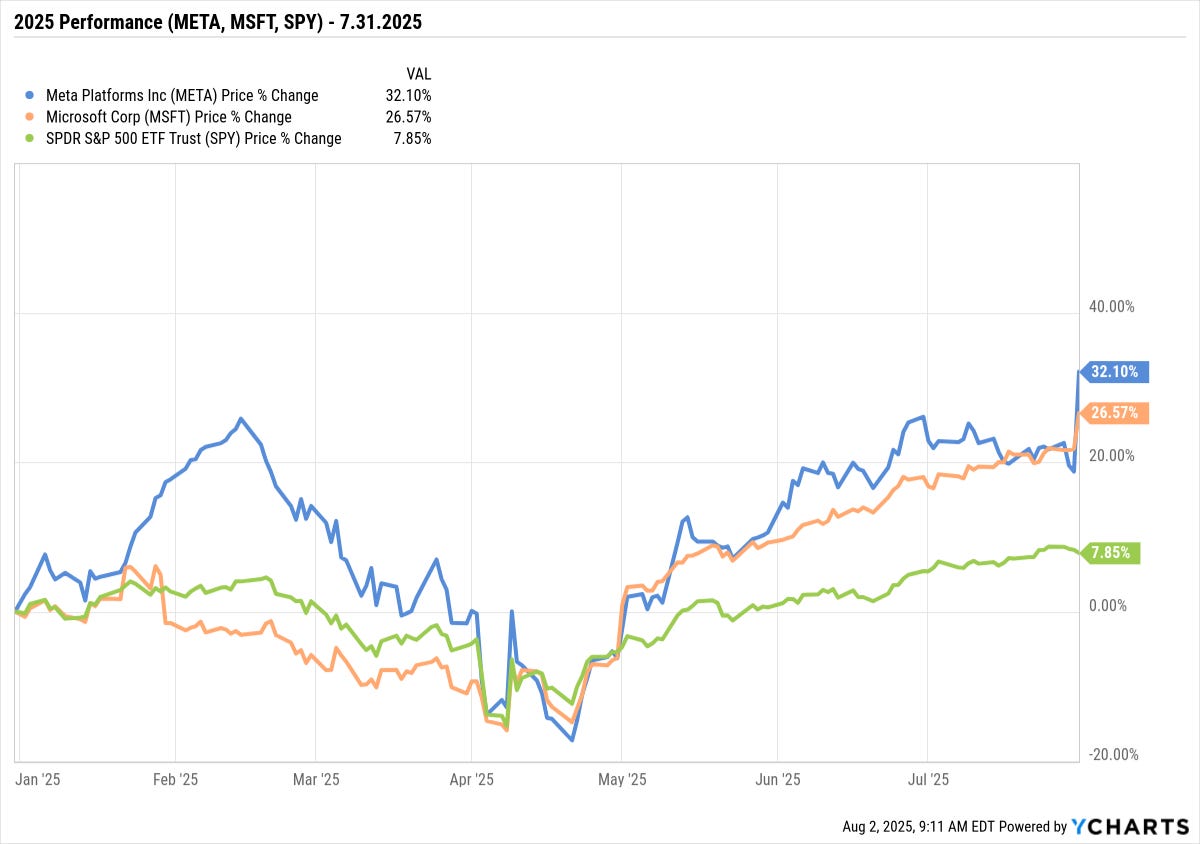

Investment markets have seen a robust recovery from this April’s “tariff tantrum” lows, providing patient investors with a “V-shaped” recovery through the end of July 2025.

As we step into August, expect a choppier environment as markets digest mixed economic data and assess the trajectory of interest rates, inflation and continued tariff and trade negotiations.

August and September are historically weaker performing months, but this is normal and healthy. I’ll cover this in the next post with some great data points and charts.

For those following, there were two big stock related events last week occurring the same afternoon with Meta and Microsoft reporting their Q2 2025 earnings and providing some very impressive results and data points.

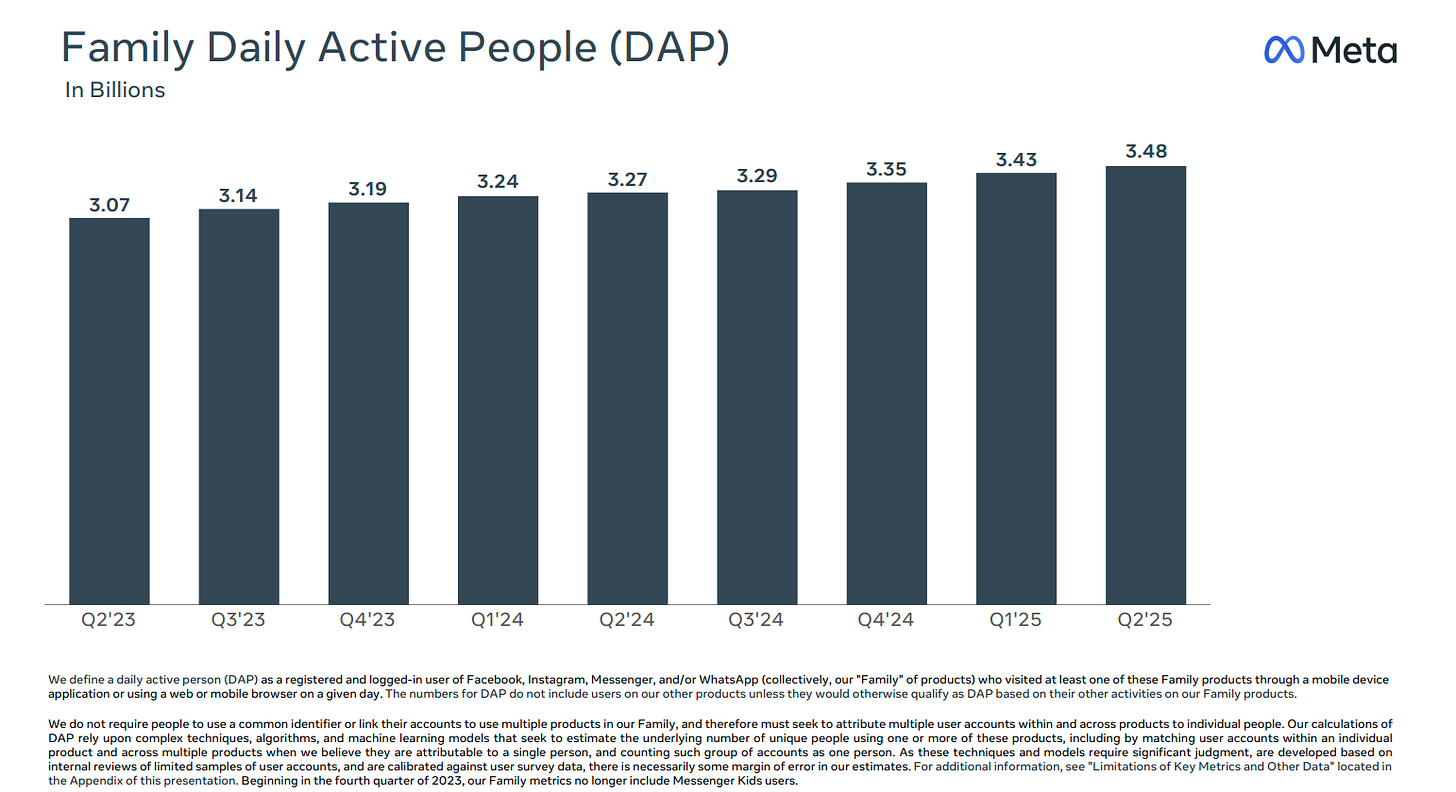

There are ~ 8.2 billion people on Earth according to the World Population Clock.

Meta (formerly Facebook) reported 3.48 billion active daily users in Q2 2025.

This means that ~ 43% of the world’s population uses one of these Meta apps, Facebook, Instagram or WhatsApp, EVERY SINGLE DAY !! 🤯

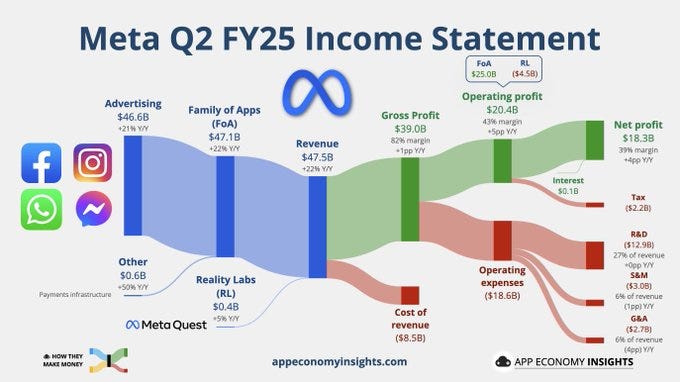

Meta is a data and advertising company. The chart below shows you how Meta makes their money?

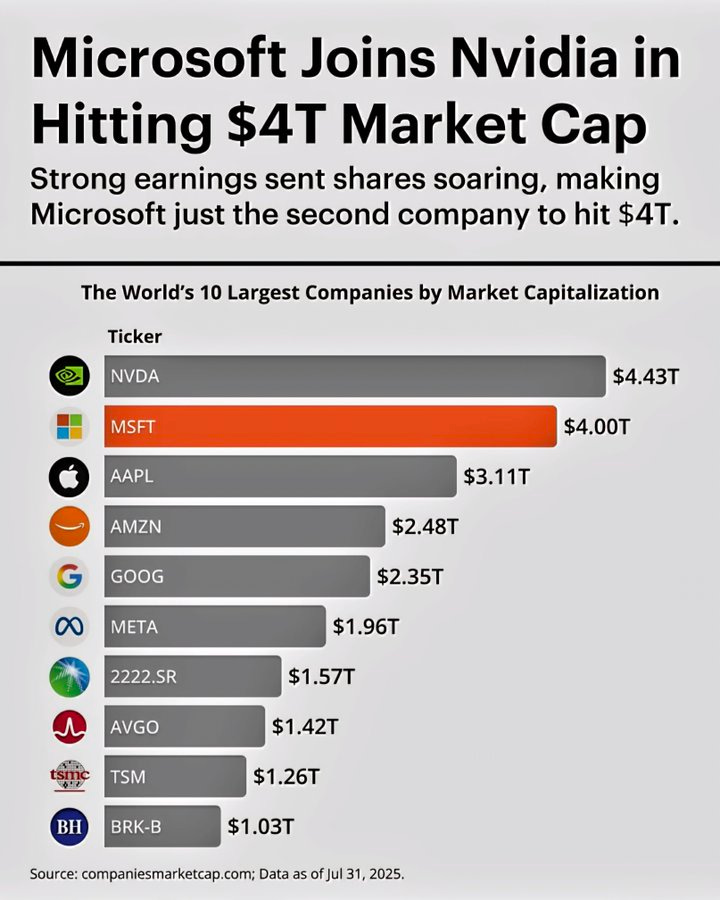

Not to be outshined by Meta’s impressive earnings last week, Microsoft also had strong earnings and joined the exclusive $4 Trillion club. Microsoft is the second most valuable company in the world and Meta jumped over $2 Trillion, making it the sixth largest company globally.

The good news is that if you invest in the S&P 500, this market cap weighted index owns a high percentage in both Meta and Microsoft, amongst the other top companies in the world.

For investors, what matters most is performance and if you invested in and owned Meta and Microsoft you have seen significant outperformance over the S&P 500 index YTD in 2025.

To add in the typical investment disclaimer, please remember that this is not investment advice and for information purposes only.