When $1 Becomes 50 Cents

Inflation’s hidden cost and the smart investing moves to fight back.

Think about natural disasters. Some hit suddenly, like an earthquake. Others build slowly, like erosion. Both can do damage, and both require preparation.

Money works the same way. Sometimes prices spike quickly (remember gas and groceries after COVID), and other times they creep up year after year. That slow rise is inflation—and it quietly affects everyone’s financial life.

Why Inflation Matters for You

If you lived through the 1970s, you remember how painful runaway inflation felt. More recently, we’ve seen prices climb after the pandemic. Today, inflation isn’t spiking at those levels, but prices are still higher than most of us would like. And with new tariffs in the headlines, there’s concern that costs could rise further.

For households, this shows up in everyday spending:

Restaurant meals are up 3.9%

Medical care is up 3.5%

Car insurance is up 5.3%

Furniture is up 3.4%

Even moderate inflation quietly chips away at your money. At just 3% inflation, costs double about every 24 years. That means $100,000 in cash today will only buy $50,000 worth of goods and services in two decades.

This chart shows why investors focus on “beating inflation.”

While inflation has pushed prices up nearly 18-fold over the past century, stocks have far outpaced both inflation and bonds, helping preserve and grow purchasing power.

The Role Inflation Plays in a Healthy Economy

Surprisingly, zero inflation isn’t ideal. Economists generally agree that a steady, low level of inflation around 2% will create the right balance for growth. But even at that level, savers who hold too much cash will fall behind.

Inflation has cooled from its 2021–22 highs, but it remains above the Fed’s 2% target in most categories. Housing, insurance, and healthcare costs continue to push family budgets higher.

What Smart Investors Can Do

Inflation isn’t something you can eliminate but it’s something you can plan for. History shows that:

Stocks and bonds have beaten inflation over time.

Cash and money market funds rarely do, especially when interest rates fall.

Diversification—owning a mix of investments that can handle different economic conditions—keeps you from being caught off guard.

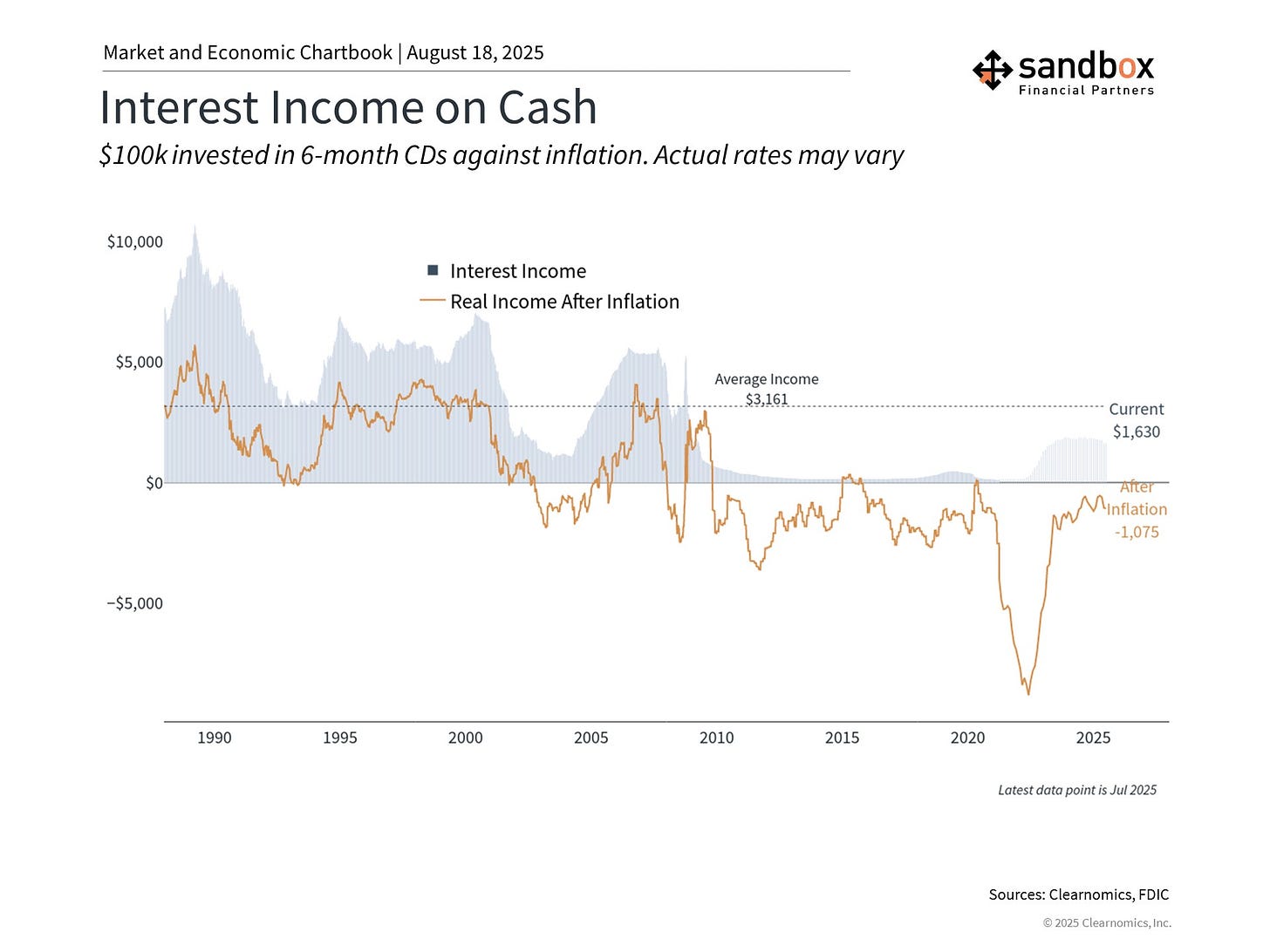

Even when CDs or money markets pay decent interest, inflation often erodes the real return. Right now, a $100,000 investment in cash-like instruments earns interest but after inflation, the real return (inflation adjusted) is still negative.

The Bottom Line

Inflation slowly erodes your money’s buying power, just like erosion wears away a shoreline. You can’t control it but you can prepare and plan for it.

The best inflation defense is a portfolio built not just for growth, but for resilience. That way, whether inflation rises fast or creeps along slowly, your financial goals remain obtainable.