What is the SALT Cap ?

New Changes for 2025 and Planning Opportunities

SALT stands for State and Local Taxes — things like your state income tax, local income tax (if applicable), and property taxes.

Before 2018, taxpayers who itemized could deduct all of these taxes from their federal taxable income.

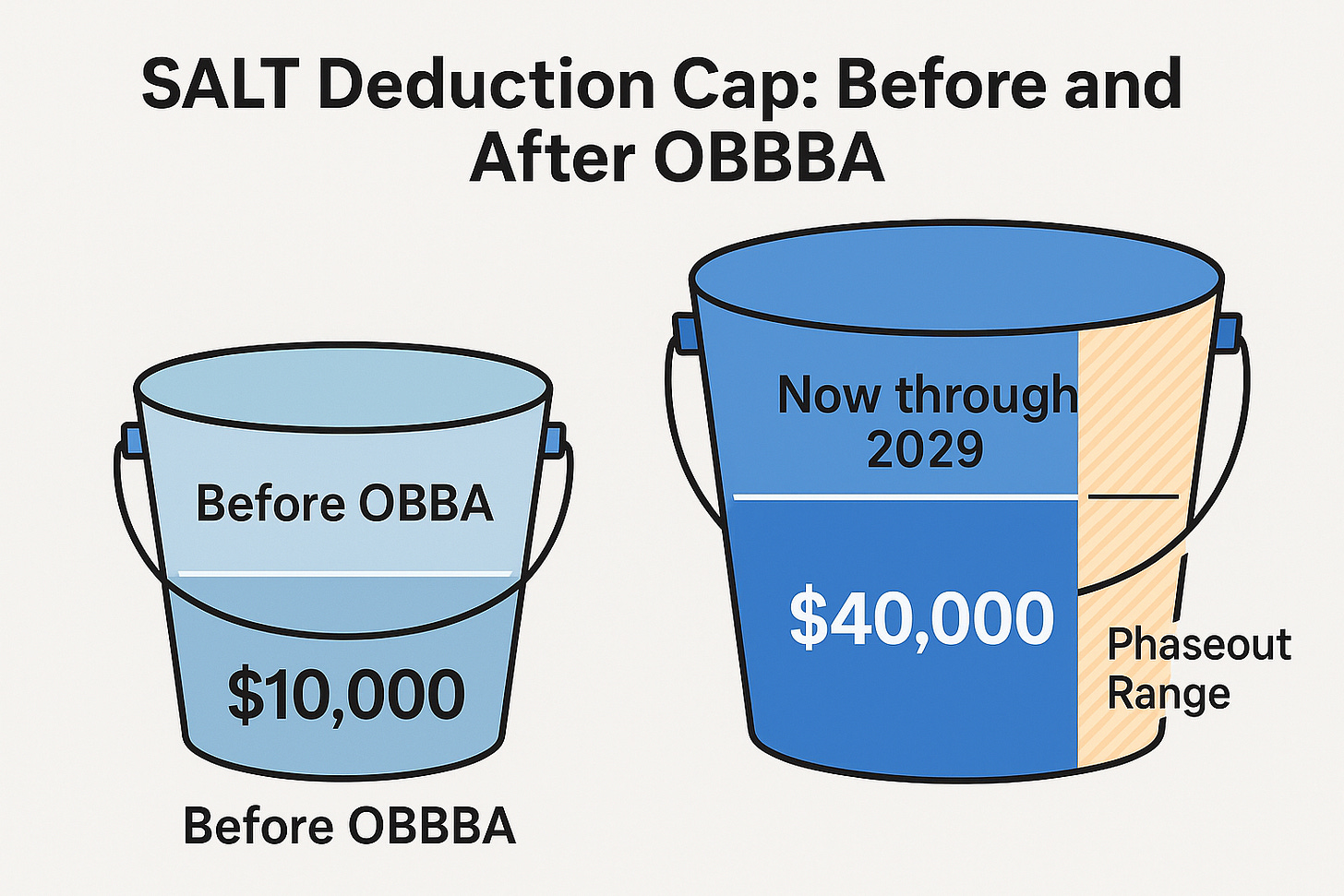

But starting in 2018, the Tax Cuts and Jobs Act (TCJA) capped the SALT deduction at $10,000 per year ($5,000 if married filing separately). This applied to the combined total of state income taxes, local taxes, and property taxes.

That meant whether your total SALT payments were $10,000 or $40,000, your federal deduction stopped at $10,000. The cap hit hardest for taxpayers in high-tax states or those with higher property taxes, where the “extra” taxes paid no longer reduced federal taxable income.

Example under the old rules:

If you paid $7,000 in state income tax and $6,000 in property taxes (total $13,000), you could still only deduct $10,000. The remaining $3,000 had no federal tax benefit.

What’s Changed: The OBBBA Update (2025–2029)

The One Big Beautiful Bill Act (OBBBA), signed into law July 4, 2025, has temporarily expanded the SALT deduction cap.

Here’s what’s new:

Bigger cap – From 2025 through 2029, the SALT cap increases to up to $40,000 for joint filers ($20,000 for married filing separately).

Annual increases – Starting in 2026, the cap rises by about 1% each year through 2029.

Temporary – In 2030, the cap reverts to $10,000 ($5,000 separate).

Phaseout for high earners:

If your Modified Adjusted Gross Income (MAGI) exceeds $500,000 (joint) or $250,000 (separate), the increased benefit begins to phase out.

The phaseout reduces the cap by 30% of the amount over the threshold, but it never drops below the original $10,000.

The income threshold also increases by about 1% per year through 2029.

Planning Opportunities

This temporary expansion creates a short-term window for potential tax savings and some clients may want to adjust their planning to take advantage:

Evaluate Itemizing vs. Standard Deduction

With the higher cap, more clients may find that itemizing deductions produces a larger tax benefit than taking the standard deduction.

Consider Timing of State & Local Tax Payments

If you can control when certain taxes are paid (e.g., property taxes), it may be worth timing them in years when the expanded cap applies — especially before it phases out for higher incomes.

Manage Income to Stay Below Phaseout Thresholds

If you’re near the $500k/$250k MAGI threshold, strategies like deferring income, accelerating deductions, or maximizing retirement plan contributions could preserve the full expanded benefit.

Leverage Other Itemized Deductions

Pairing a higher SALT deduction with other deductions (such as charitable giving or mortgage interest) could create a larger total deduction and reduce taxable income further.

Business Owner Workarounds

Pass-through business owners may still benefit from state-level entity taxes that bypass the SALT cap entirely, potentially stacking benefits with the new higher limits.

Why This Matters

More room for deductions – For clients in high-tax states or with significant property taxes, this could mean thousands more in deductible expenses for the next five years.

Income planning opportunity – Clients near the phaseout threshold may benefit from strategic income management to maximize their SALT deduction.

Use it while it lasts – The window is short: 2025–2029. In 2030, we’re back to the old $10,000 limit.

Must itemize – You still need to itemize deductions to benefit; the standard deduction remains available as an alternative.

Final Thought

The new SALT cap rules present opportunities, but the right approach will depend on your personal tax situation, income level, and whether you itemize deductions. Because the expanded cap is temporary and includes income-based phaseouts, planning ahead is key.

Be sure to review your specific circumstances with your tax advisor to determine how to make the most of these changes.