Washington Shuts Down. Markets March On.

Markets have powered through every shutdown in history

As financial planners and investment advisors, our job is to help clients focus on what truly matters to their long-term progress and ignore the noise of daily headlines.

And right now, one headline dominates: the ongoing government shutdown which is now the longest in U.S. history.

While it’s easy to feel anxious amid the uncertainty in Washington, history tells a clear story: government shutdowns have had little lasting impact on markets or investor outcomes.

Putting It in Perspective

The current shutdown has caused real pain for government employees and those who rely on government services. By law, furloughed employees will eventually receive back pay, but the disruption is significant for many households.

That said, it’s important to separate the emotional impact from the economic impact.

Federal employment is small. Government workers make up only 1.8% of the total U.S. workforce, and recent “reduction in force” notices represent a mere 0.0018% of total employment.

Growth slowdowns are temporary. Shutdowns can briefly weigh on GDP as federal workers cut spending and services pause but this activity typically rebounds once operations resume.

Markets move on fundamentals. Corporate earnings, valuations, interest rates, and inflation drive long-term returns and not political standoffs.

History is reassuring. The last major shutdown (35 days in 2018–19) was followed by a 31.5% total return in the S&P 500 that same year.

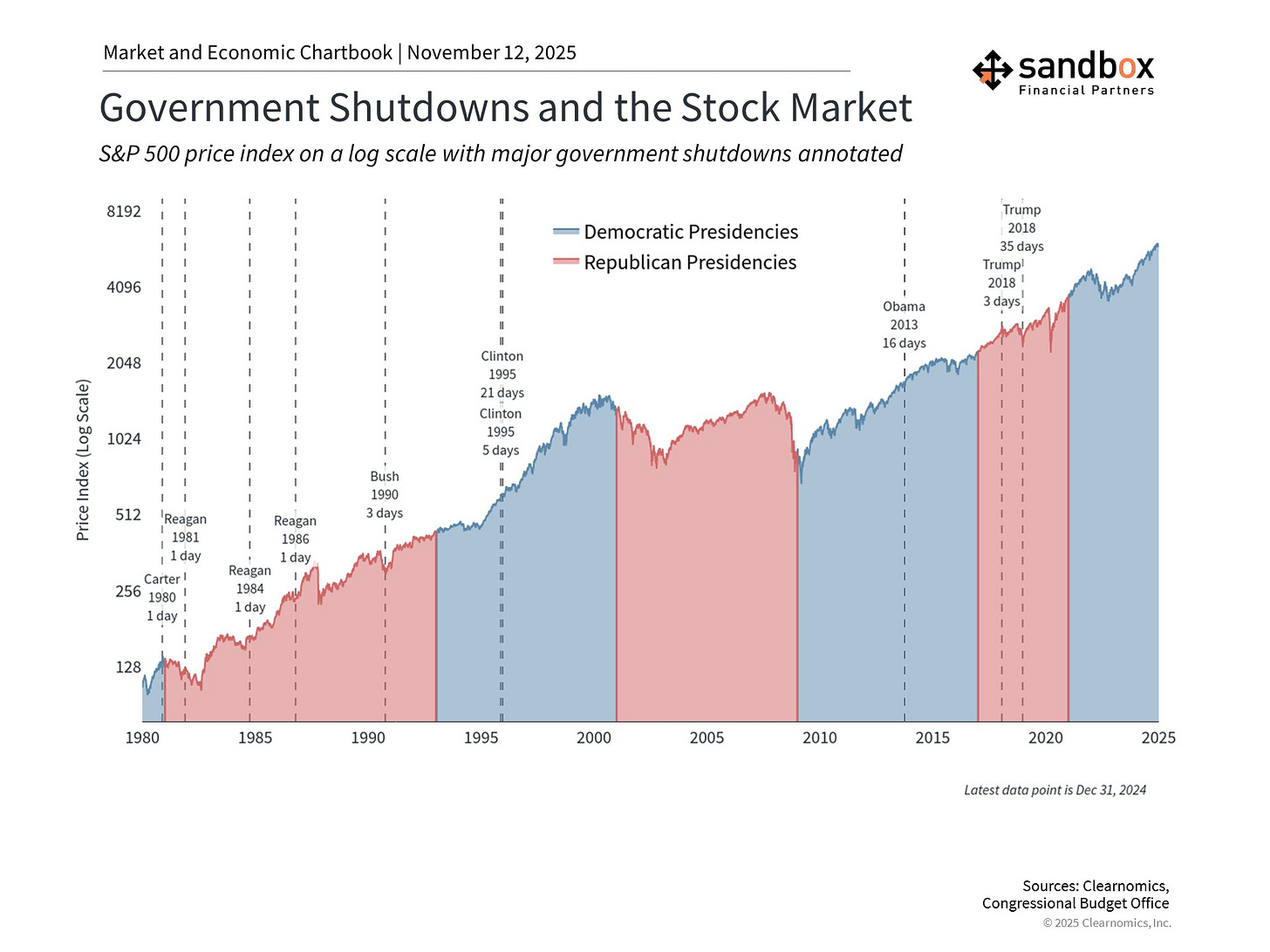

A Look Back: Markets Through Shutdowns

The chart below highlights every major government shutdown since 1980 — across both Democratic and Republican presidencies. Despite repeated political standoffs, the long-term trend in the S&P 500 has been unmistakably upward.

Market reactions to shutdowns have historically been short-lived — while investors who stayed invested were rewarded for their patience.

What’s Happened This Time?

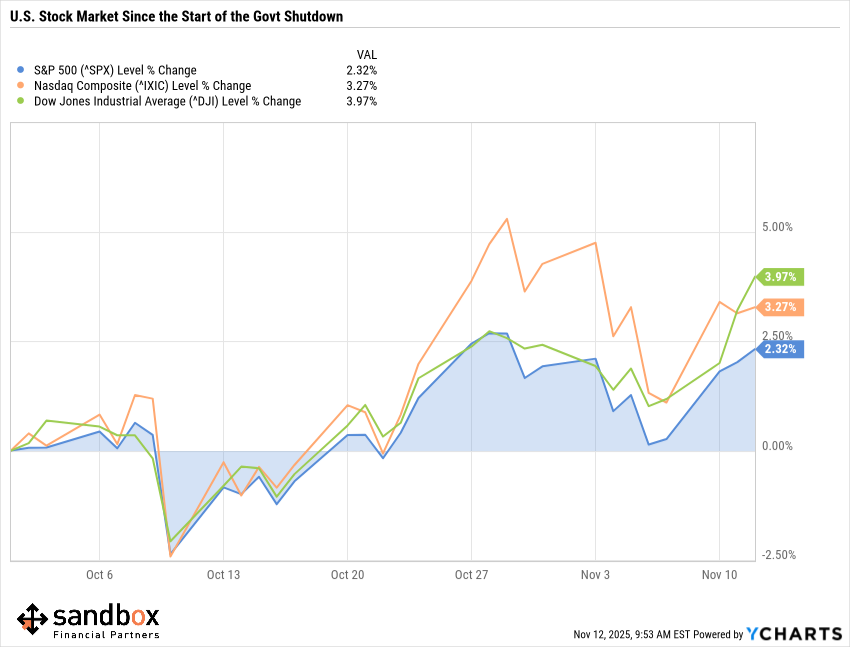

So far, markets have taken the latest shutdown in stride.

Since the government closure began in early October, all three major U.S. indexes have posted gains — with the Dow up 3.9%, the Nasdaq up 3.3%, and the S&P 500 up 2.3%.

This short-term resilience underscores the same pattern we’ve seen for decades:

While shutdowns can cause temporary disruptions, markets often continue to reflect corporate earnings, consumer spending, and long-term economic growth far more than political noise.

The Takeaway

Shutdowns dominate the news cycle, disrupt services, and affect many families. But for investors, they’ve historically been speed bumps, not roadblocks.

So while Washington debates, remember: Your financial plan is built to outlast headlines.

If your goals or circumstances have changed — or if current events have you second-guessing your plan — let’s talk. We’ll review your plan together to ensure it still aligns with what matters most to you. Contact us today to start that discussion.