Time to Bail or Time to Buy?

When emotions are high, staying grounded matters most.

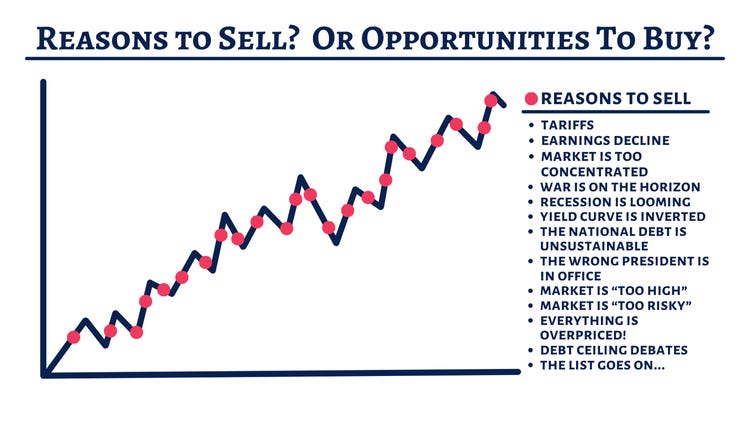

Reason to Sell or Opportunity to Buy

2025 is proof that investing (and staying invested) isn’t easy.

Tariffs, recessions, elections, yield curve fears — there's always a reason to worry. But long-term investors know: headlines create noise and an opportunity.

📉 Every red dot was a "reason to sell."

📈 Yet the market eventually recovered and kept climbing.

This chart is a simple reminder that panic isn't a plan.

Stay focused, stay invested, and trust your process.

Taking the chart above and transposing it to actual events, showing the Dow Jones back to 1900 with many of the major geopolitical events listed. When uncertainty is at extremes, it’s important to step back (or step away) and for perspective, simply zoom out.

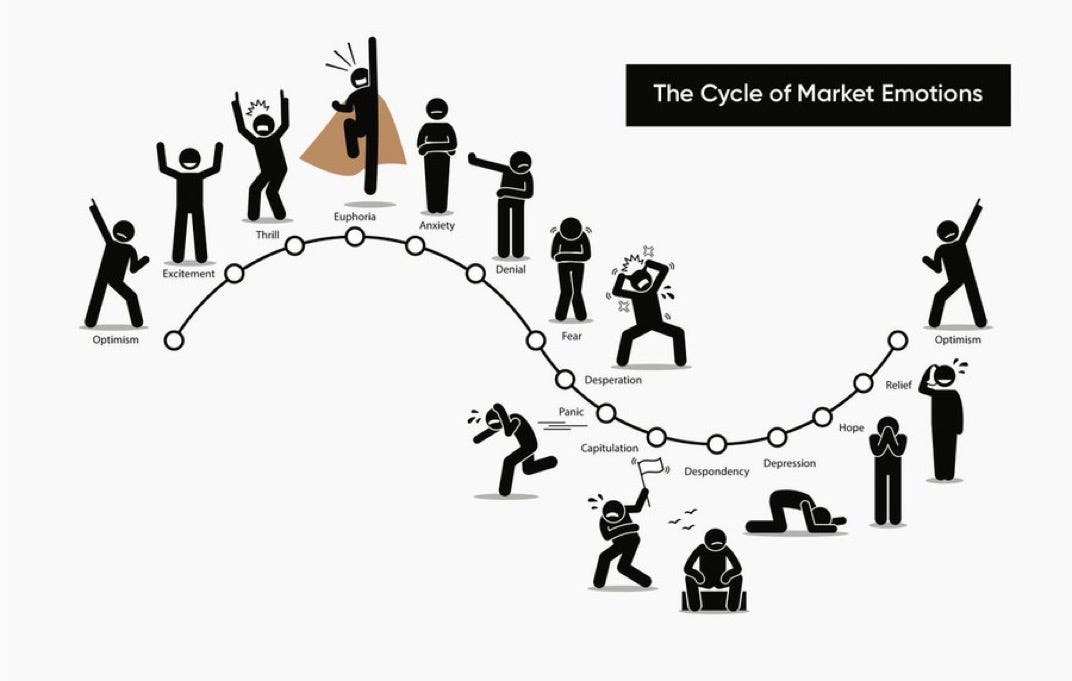

The Cycle of Market Emotions

We joke that investors are never truly happy.

📈 When the market’s up, they wish they had invested more.

📉 When it’s down, they regret being invested at all.

The cycle of emotions never stops—but successful investing isn’t about feeling good all the time.

It’s about staying the course, trusting the plan, and letting time do the heavy lifting.

Why Staying Invested Matters

Trying to time the market can be costly — and this chart proves it. Over the past 25 years, just missing a few of the best days in the market drastically reduced investment returns.

Key takeaways:

A $1,000 investment in the S&P 500 grew to $4,919 if you stayed fully invested.

Miss just the best single day, and it drops to $4,409.

Miss the best 10 days, and it falls to $2,190.

Miss the best 40 days, and you're left with just $548 — even less than your starting amount.

Bottom line: The best days often come when things feel the worst. Sticking to your plan and staying the course matters.

For when the next scary headline appears, bookmark this page and come back for a quick read. You’re future financial self will thank you for not making an emotional decision to panic sell. And maybe, you’ll view it as an opportunity to buy on sale.