The Janitor Who Built an $8 Million Fortune

The inspiring story of Vermont's Ronald Read

A Quiet Fortune

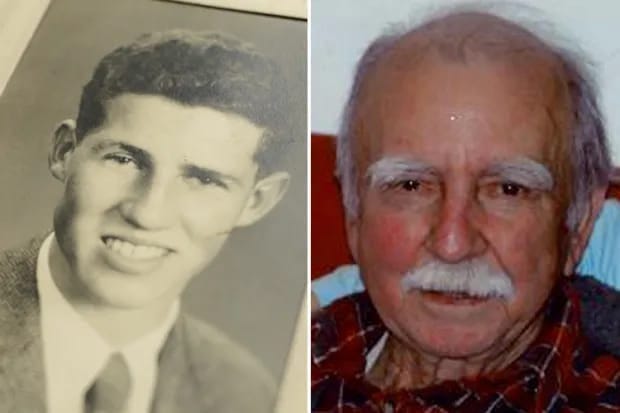

Ronald Read spent his life pumping gas and sweeping floors in Brattleboro, Vermont. When he died in 2014 at age 92, neighbors thought of him as a modest man with a used Toyota and a coat pinned together with safety pins.

Then the surprise came: Read had quietly amassed an $8 million fortune, most of which he donated to a local library and hospital. His gifts extended library hours, renovated a 50-year-old building, and helped improve healthcare in town.

How He Invested

Read never earned a big salary. He worked at a gas station and later as a JCPenney janitor. But in a safe deposit box, he left behind a five-inch stack of stock certificates: at least 95 companies, held for decades.

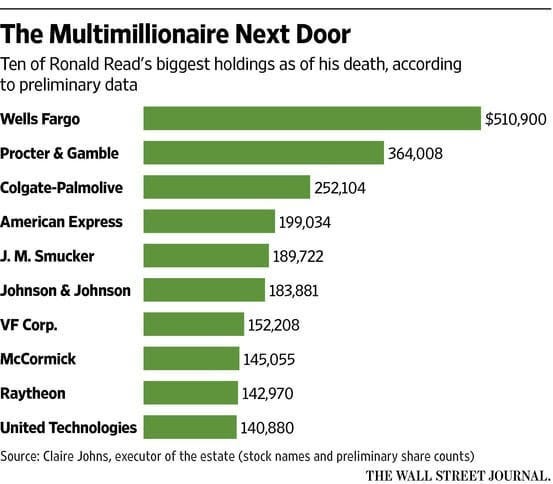

He favored railroads, banks, utilities, and consumer staples, companies he knew and that paid dividends. He reinvested those dividends, buying more shares year after year. His biggest holdings included Procter & Gamble, Johnson & Johnson, J.P. Morgan Chase, and General Electric.

Read wasn’t perfect, of course. No investor is, not even Warren Buffett. Read’s portfolio even held Lehman Brothers when it collapsed in 2008. But he diversified, avoided chasing fads, and let compounding do the heavy lifting. He didn’t panic sell during bear markets when the headlines got scary.

A Life of Simplicity

Born in 1921, Read was the first in his family to graduate high school. After serving in World War II, he came home to Vermont, married, and raised two kids. He lived frugally, cutting his own firewood into his 90s, driving old cars, and saving nearly 80% of his income.

“I’m sure if he earned $50 in a week, he probably invested $40 of it,” a neighbor recalled.

The Power of Patience

Read rarely sold stocks. In fact, because he owned physical certificates, selling required trips to the bank and brokerage office, a built-in safeguard against impulsive trades.

Starting young and living long gave him compounding’s full force. Investing about $300 a month at an 8% return for 65 years turned a modest paycheck into millions.

What We Can Learn

Most investors chase the next big trade or wait too long to get serious. Read showed another way:

Start early

Live below your means

Reinvest dividends

Stay patient

As Barry Ritholtz puts it: “Most investors don’t take advantage of time. They start saving too late, they’re not patient, and they don’t allow the years to work in their favor.”

Ronald Read did, and in doing so, he proved that extraordinary wealth doesn’t require an extraordinary income… rather, it requires extraordinary discipline.

My kind of guy.