Stop Letting Your 401(k) Underperform

Are Target Date Funds Dragging Your 401(k)?

When’s the last time you checked your 401(k) allocation?

It’s easy to “set it and forget it” when it comes to retirement accounts. Target Retirement Funds (“TDF”) have made this a much more common strategy amongst savers. And I know that it’s a nice surprise when you open your 401(k) statement years later and you have a significantly larger balance than you ever imagined.

But here’s the thing, if you’re on the younger side with decades until retirement, your risk tolerance likely should be higher than what your TDF assumes.

Vanguard Retirement Data from 2023 shows that on average, 62% of 401(k) account balances go into TDFs, and 83% of new contributions flow into them.

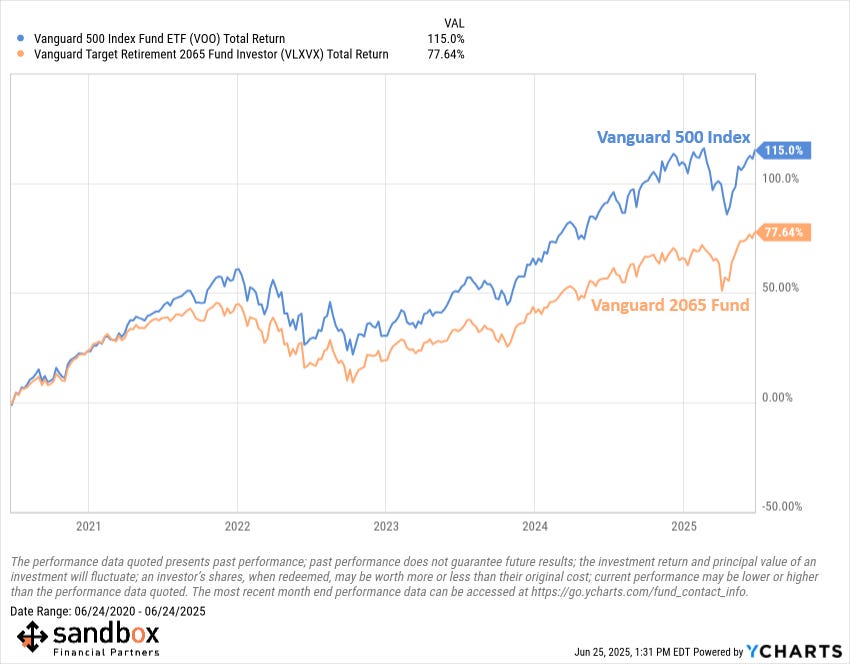

But take a look at this:

Vanguard Target Retirement 2065 Fund (5-year return): +77%

Vanguard S&P 500 ETF (5-year return): +115%

With a $50,000 investment, that’s a difference of over $18,680 in gains over just five years, and will compound to an even bigger differential over longer time horizons.

Target date funds aren’t bad, they’re a simple, diversified and hands-off solution. But they’re also conservative by design. You might be leaving a lot of potential growth on the table if you never revisit your allocation.

❌ Why Target Retirement Funds May Not Be Ideal for Everyone:

One-Size-Fits-All Approach:

Target date funds don’t consider your personal risk tolerance, financial goals, or other investments since they are based solely on age or anticipated retirement year.Too Conservative for Younger Investors:

These funds often reduce risk too early by allocating more to bonds, which can limit long-term growth potential for savers with decades until retirement.Too Conservative for Older Investors:

Some older investors may actually need more growth, not less. Especially you’re retiring early or planning for a long retirement. Overly cautious target date funds or a tough stretch for the bond market, then your 401(k) might not keep pace with inflation or your retirement income needs.

Hidden or Higher Fees:

Some target date funds come with layers of fees (fund-of-funds structure), which can quietly reduce your returns over time.Less Flexibility or Control:

You can’t easily adjust the asset allocation inside the fund. If you want to be more aggressive or conservative, your only option is to switch to a different fund entirely. For example, if you want to own more Technology or Artificial Intelligence stock exposure, you’ll need to buy another fund to do that.Underperformance Compared to Index Funds:

Many target date funds underperform low-cost index funds like the S&P 500 ETF, especially over longer time horizons due to their diversified mix of underlying investments.

✔️ Action step: Log in to your 401(k) and check your investment selections.

If you’re comfortable with more risk and have a long time horizon, consider shifting toward a more aggressive option like a low-fee S&P 500 index fund. All employer retirement plans should have this as an investment option.

Retirement may feel far off but small tweaks today can snowball into real wealth tomorrow.

Now, here is the typical disclaimer, as this is NOT investment advice and everyone’s financial situation is unique and the investment options available in your 401(k) plan different (and often limited, by design).

But at the very least, ensure your 401(k) is aligned with your investing and retirement goals. Investments options occasionally change in your plan and you should ensure you are aligning your investments to your risk tolerance, time horizon and retirement plan.

If you need assistance or simply want a second set of eyes to review, we’re here to help.