🏠 Squeezed by Housing Costs

Why owning a home in DC (and across the U.S.) has never felt so out of reach

For decades, owning a home has been central to the “American Dream.” But today, that dream is slipping further away for many families — both here in the DC area and nationwide.

According to the Atlanta Fed’s Home Ownership Affordability Monitor (HOAM), the typical household is now spending close to half of their income just to cover the cost of a median-priced home.

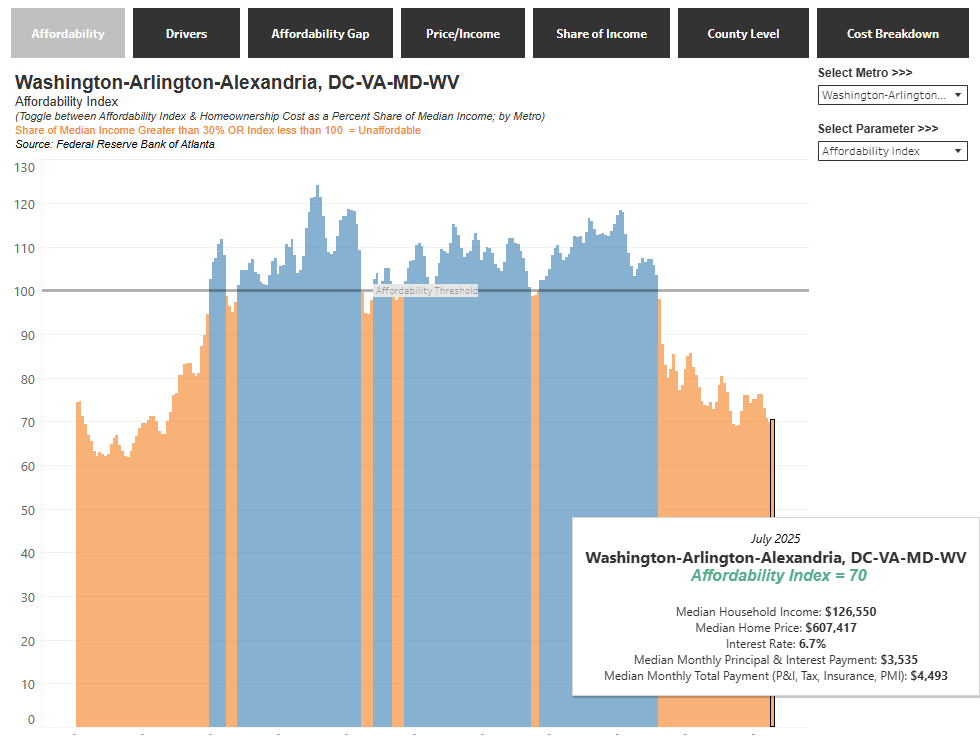

DC Metro: Nearly Half Your Paycheck to the Mortgage

Here’s what the July 2025 numbers show for our region:

Median Household Income: $126,550

Median Home Price: $607,417

Median Monthly Payment (mortgage, taxes, insurance): $4,493

Share of Income to Housing: 48%

Affordability Index: 70 (anything below 100 = unaffordable)

That means the “average” family in the DMV puts nearly half of their paycheck toward housing, which is far above the 30% threshold that defines affordability.

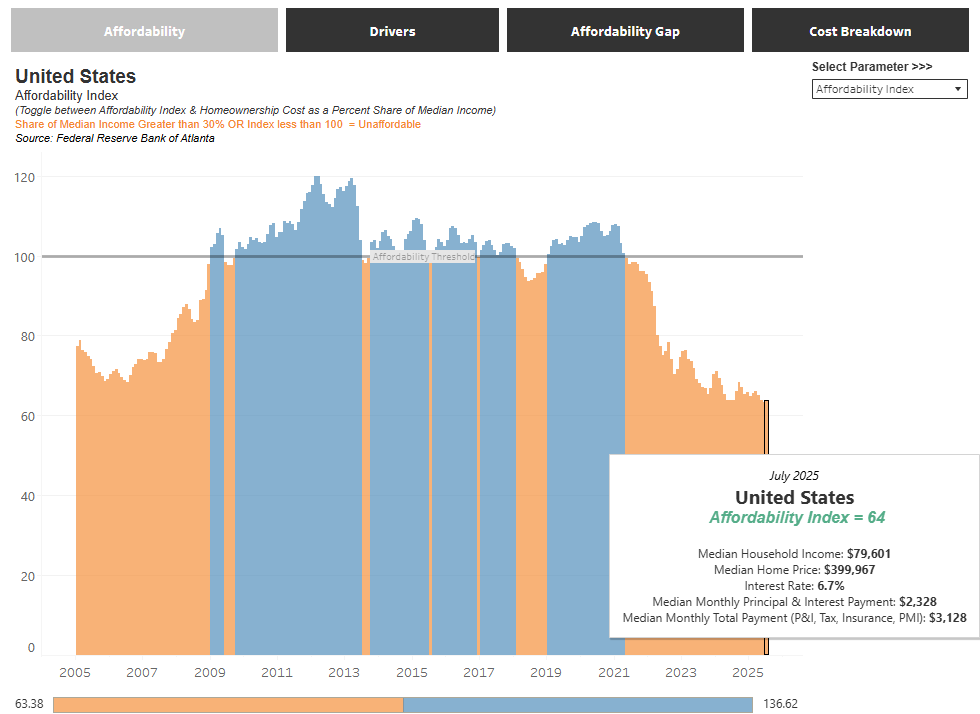

The National Picture: Not Much Better

The affordability crunch isn’t just local. Nationally:

Median Household Income: $79,601

Median Home Price: $399,967

Median Monthly Payment: $3,128

Share of Income to Housing: 47%

Affordability Index: 64

That’s the lowest level of affordability in nearly two decades.

And one reason affordability isn’t improving is that many homeowners are “locked in” with ultra-low mortgage rates. They’re staying put, which means fewer homes on the market, pushing prices higher for everyone else. I covered this dynamic in a recent Sandbox Pulse titled Locked In by Low Rates.

A Look Back: Why Today Feels Different

To understand how extreme things have gotten, let’s put today’s numbers in context:

In 2006, just before the housing crash, households were spending about 41% of their income on housing. We’re now well above that at 47%.

In 2010-2015, affordability was much better. Many families were only spending around 25–30% of income on housing.

In 2021, affordability was already slipping, but the typical share of income was closer to 32–33%.

Put simply: in just a few short years, the cost burden has ballooned from one-third of income to nearly half.

Why It Matters

When families spend this much on housing:

They have less money left over for saving, investing, or day-to-day living.

Mobility slows down, meaning people can’t move as easily for new jobs or opportunities.

Younger buyers face bigger hurdles, making it harder to build wealth through homeownership.

Can It Be Fixed?

There’s no simple solution, but some ideas include:

Building more homes to increase supply.

Zoning reforms to allow more affordable housing types.

Targeted assistance programs for first-time buyers.

Policy changes to ease the burden of high property taxes and insurance.

Bottom Line

Here in DC, the average family would need to devote nearly half their income just to afford the average home. Nationally, the story is the same.

Housing affordability isn’t just a statistic, it’s reshaping how families live, work, and plan for the future. And unless something changes, the “American Dream” of homeownership will remain out of reach for millions.

Related Reading You’ll Find Helpful

Locked In by Low Rates — Why today’s market is frozen, and how low-rate mortgages are trapping homeowners in place.

Rent vs Buy — If you’re weighing renting versus buying in today’s market, here’s how to think through the tradeoffs.

Live More, Worry Less

At Sandbox, we know affordability challenges make financial planning feel overwhelming. Our goal is to help families Live More, Worry Less by putting housing costs into the bigger picture of your long-term financial plan.

And you don’t have to navigate this market alone. If you need trusted professionals — from real estate agents to mortgage brokers — we can connect you with experts in our network who understand today’s environment and can guide you through the process.

While affordability is a national issue, the decisions you make for your family are personal and having the right plan and the right partners can make all the difference.