Rent vs Buy

Higher Prices, Higher Rates but what is right for you?

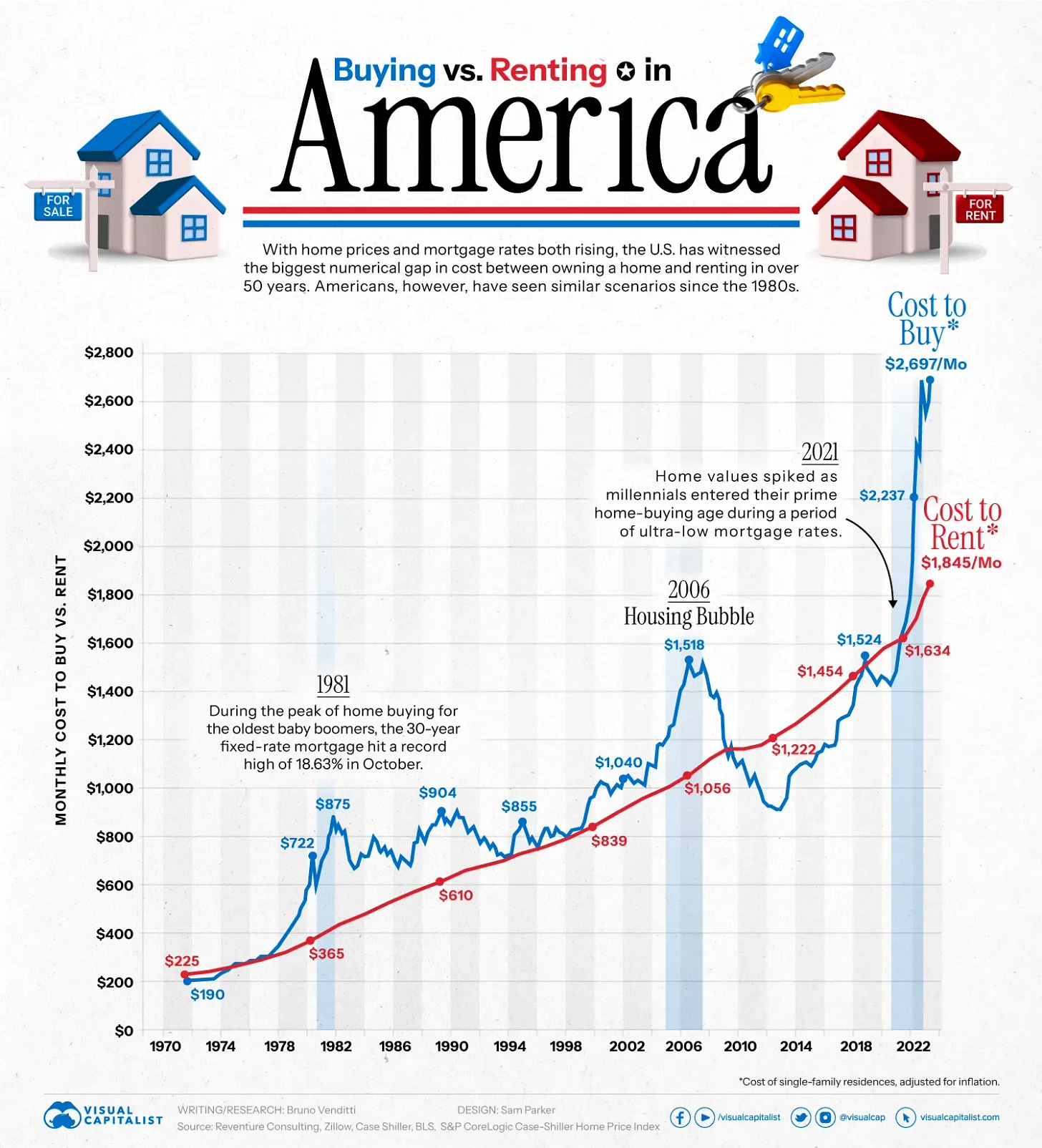

For past generations, the pillars of the American Dream were straightforward: land a steady job, buy a home, maybe start a family. But today, with sky-high home prices and elevated mortgage rates, homeownership feels increasingly out of reach for many young people.

Renting vs. Buying

There’s no one-size-fits-all answer—it’s all about what’s right for you!

Rent if:

🏠 You’re not ready or interested in homeownership.

📍 You’re unsure about staying in one spot for 5+ years.

🌍 You’re new to an area and still figuring things out.

💸 You’re saving up for your dream home.

✨ You value flexibility and freedom to move.

Buy if:

🌱 You’re ready to plant roots and settle down.

💵 It’s within your financial comfort zone.

📆 You plan to stay for the long haul.

✔️ It aligns with your life goals and priorities.

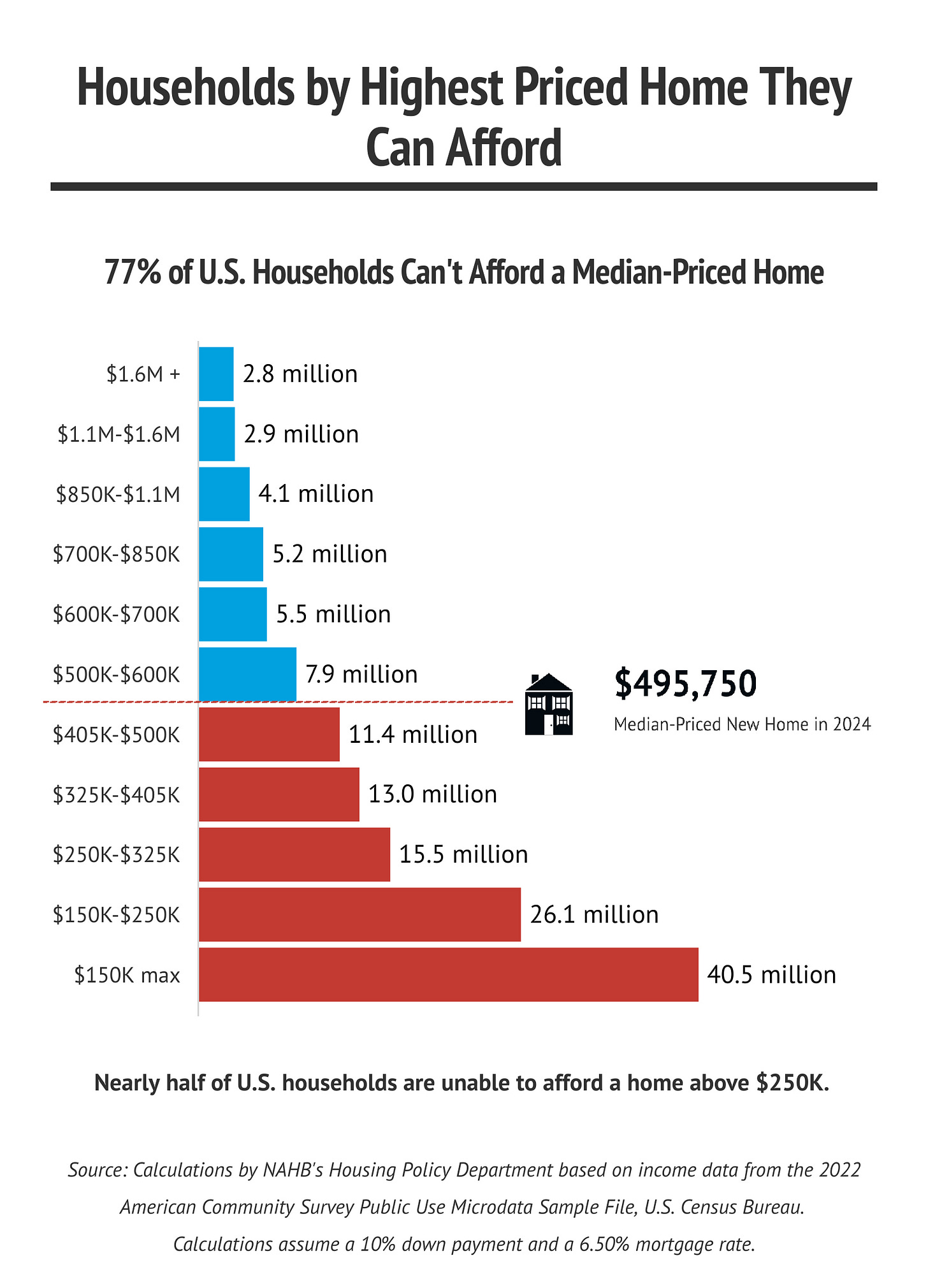

In 2024, a homebuyer needed to earn an annual income of at least $116,782 to spend no more than 30% of earnings on monthly housing payments for a median-priced home.

This is a record high and more than $33k more than typical household makes in a year per Redfin.

With mortgage rates hovering just below 7.00% on a 30 year fixed mortgage and staying near the high end of their range over the prior few years, it has lowered home affordability for new purchasers. Add in higher real estate values in many parts of the country, interest rates become a big factor in cash flow planning as the monthly cost of home ownership has increased for those obtaining a mortgage.

The New Reality: $1M Starter Homes in 233 U.S. Cities

According to a recent Zillow report, the number of U.S. cities where starter homes cost at least $1 million has surged to 233, up from just 85 five years ago.

Key Highlights:

California leads with 117 cities where starter homes exceed $1 million, followed by New York (31) and New Jersey (21).

Even traditionally affordable states like Minnesota and Rhode Island now have cities with million-dollar starter home.

Nationally, the typical starter home is valued at $192,514, but prices have grown 54.1% over the past five years.

The median age of first-time homebuyers has risen to 38, with their share of home purchases dropping to a record low of 24%

As you consider your options to Rent or Buy, remember that there is not a one-size-fits-all answer, and it’s all about what’s right for you. Understand the pros and cons, review your cash flow and discuss with your financial planner, or contact Sandbox Financial Partners to start the discussion today.