Protect Yourself and Your Money from New Scams

Scammers are getting smarter, but a few simple rules can keep your money and identity safe

Fraud isn’t new, but the tactics keep evolving. With AI, hacked accounts, and social media, scammers have new ways to make their schemes look real. Falling victim can cost thousands, or worse, expose your identity. Staying alert is your best defense.

Before diving into examples, it’s worth briefly recognizing how pervasive this issue has become. The Federal Trade Commission reported that Americans lost $12.5 billion to scams in 2024, a figure that’s likely underreported since many victims are too embarrassed or unsure how to file a report. The most financially damaging were investment scams, where older adults in their 70s lost a median of $20,000: proof that nobody, regardless of age or experience, is immune.

Here are three scams making the rounds and how to spot them before it’s too late.

1. Lawyer Impersonation

Scammers pretend to be lawyers or government officials, typically targeting people who may be intimidated by legal threats. They’ll usually pressure you with urgent phone calls or emails, demanding immediate payments or sensitive information.

➡️ How to protect yourself:

Legitimate lawyers and agencies won’t ask for urgent payments over the phone. If you’re unsure, look up the person’s name through your state bar association or call the agency directly.

2. Celebrity Relationship Scam

A scammer builds a fake online profile posing as a celebrity. They might reach out via social media, charm you with AI-generated calls or videos, and then suddenly ask for “help,” usually money, gift cards, or wire transfers.

➡️ How to protect yourself:

No celebrity is asking strangers for money in their DMs. Even verified accounts can be hacked, so don’t send money to someone you haven’t met in person.

3. Business Email Compromise

You receive an email from a trusted vendor stating that their payment account has been updated. Everything looks legitimate—same logo, same tone of voice—but the new account belongs to a fraudster. Once you pay, the money vanishes.

➡️ How to protect yourself:

Pause before you hit send. Confirm any payment or account changes with your contact using a verified phone number, not the one in the suspicious email.

Three Rules of Thumb

Verify first. Double-check calls, texts, and emails before sharing personal or financial details.

Be skeptical of urgency. Pressure is a red flag.

Never pay with gift cards. No real business or government agency will ask for them.

A Few More Ways to Stay Protected

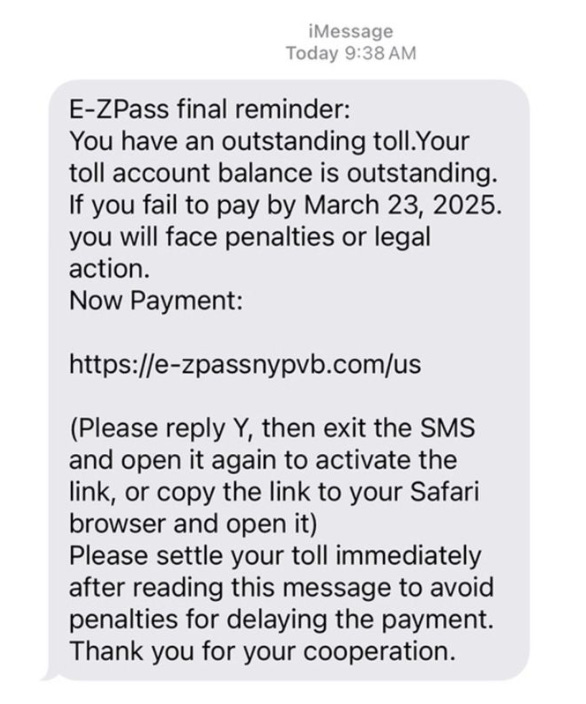

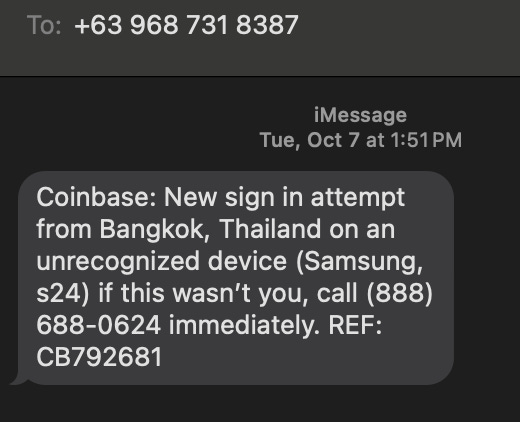

Ignore unsolicited messages from unknown numbers or emails.

Avoid clicking suspicious links, even if they appear to come from trusted sources.

Use antivirus and anti-malware software to regularly scan your devices.

When in doubt, trust your gut; if something feels off, it probably is.

Live More, Worry Less

At Sandbox, we know fraud and scams can make financial planning feel overwhelming. Our goal is to help families “Live More & Worry Less” by building safeguards into your broader financial plan.

You don’t have to navigate this alone. If you need trusted professionals, from estate attorneys to cybersecurity specialists, we can connect you with experts in our network who understand today’s risks and can help protect your future.

While scams are a national problem, the choices you make for your family are personal. Having the right plan and the right partners can make all the difference.