One Big Beautiful Bill

How the OBBBA may impact your Finances

On July 4, 2025, the "One Big Beautiful Bill Act" (OBBBA) was signed into law, introducing significant changes to the U.S. tax code and federal spending.

Here's an overview of the key provisions and how they might impact your financial planning:

🧾 Tax Provisions

1. Permanent Extension of 2017 Tax Cuts

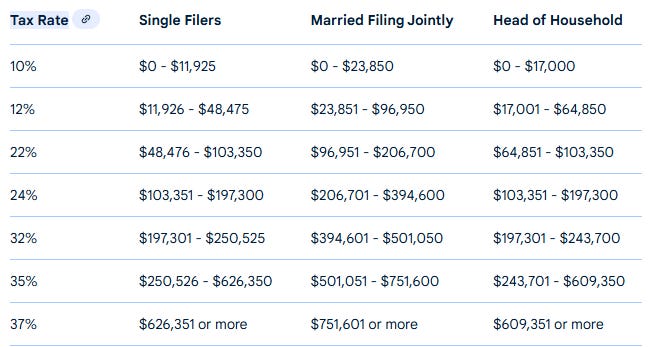

The individual income tax rates established under the 2017 Tax Cuts and Jobs Act (TCJA) are now permanent, preventing the previously scheduled increase at the end of 2025.

Note: These brackets represent ordinary income tax rates, and the 10% and 12% brackets will receive an extra inflation adjustment bump in 2026, slightly increasing their income thresholds compared to what they would have been without the adjustment.

2. Standard Deduction Increase

The standard deduction has been increased to $15,750 for single filers and $31,500 for joint filers, indexed for inflation.

3. State and Local Tax (SALT) Deduction Cap

The SALT deduction cap has been raised from $10,000 to $40,000 for tax years 2025 through 2029, benefiting those in high-tax states. However, this benefit phases out for taxpayers with modified adjusted gross incomes (MAGI) over $500,000.

4. Qualified Business Income (QBI) Deduction

The 20% QBI deduction for pass-through entities has been made permanent, with relaxed income-based phaseouts, providing ongoing tax relief for business owners.

5. New Deductions for Workers

"No Tax on Tips": Tip income is deductible up to $25,000 for workers in eligible occupations from 2025 to 2028.

"No Tax on Overtime": Overtime pay is deductible up to $25,000 for workers earning under $150,000 (single) or $300,000 (married) through 2028.

Car Loan Interest Deduction: Interest on loans for U.S.-assembled vehicles is deductible up to $10,000 annually, with income phaseouts starting at $100,000 (single) and $200,000 (married).

6. Senior Tax Deduction

Seniors aged 65 and older can claim an additional $6,000 standard deduction from 2025 to 2028. This phases out for individuals with MAGI over $75,000 and couples over $150,000.

7. Child Tax Credit Enhancement

The Child Tax Credit increases from $2,000 to $2,200 per child and is now indexed to inflation. However, the refundable portion remains unchanged, potentially limiting benefits for lower-income families.

8. Introduction of "Trump Accounts"

New tax-advantaged savings accounts for children born between 2025 and 2028:

$1,000 government seed contribution

Annual parental contributions up to $5,000

Funds grow tax-deferred and can be used for education, job training, or home purchases

9. Estate and Gift Tax Exemption Increase

The estate and gift tax exemption increases to $15 million per individual ($30 million per couple) starting in 2026, indexed for inflation.

🏛️ Broader Policy Changes

1. Medicaid and SNAP Cuts

Over $1.2 trillion in reductions to Medicaid and food assistance programs, with changes taking effect post-2026.

2. Clean Energy Incentives

Phasing out of electric vehicle and solar tax credits, with some expiring as early as 2025.

3. Increased Defense and Border Security Spending

$350 billion allocated for border enforcement and defense initiatives.

📊 Financial Planning Considerations

High-Income Clients: Evaluate the benefits of the increased SALT deduction and potential limitations due to income phaseouts.

Business Owners: Leverage the permanent QBI deduction and explore opportunities under the expanded Qualified Small Business Stock (QSBS) provisions.

Families: Consider opening "Trump Accounts" for eligible children to maximize long-term savings.

Seniors: Assess eligibility for the additional standard deduction and its impact on taxable income.

Consult with your financial planning team, or contact us to start the conversation today.