More Millionaires Than Ever — And Less to Show for It

The quiet "cash" crisis facing America’s new millionaires

More millionaires. Less cash. Bigger risks.

A recent Bloomberg analysis revealed a striking paradox: The number of U.S. millionaires has surged since 2017 — but a growing share of them can’t easily access their wealth.

Much of today’s “new money” is locked away in home equity, private businesses, and retirement accounts. These are powerful wealth builders but poor liquidity sources.

The result?

Many households look financially strong on paper but struggle to fund life transitions, opportunities, or unexpected costs without selling long-term assets.

It’s a reminder that net worth is not the same as financial freedom.

The New Shape of Millionaire Wealth

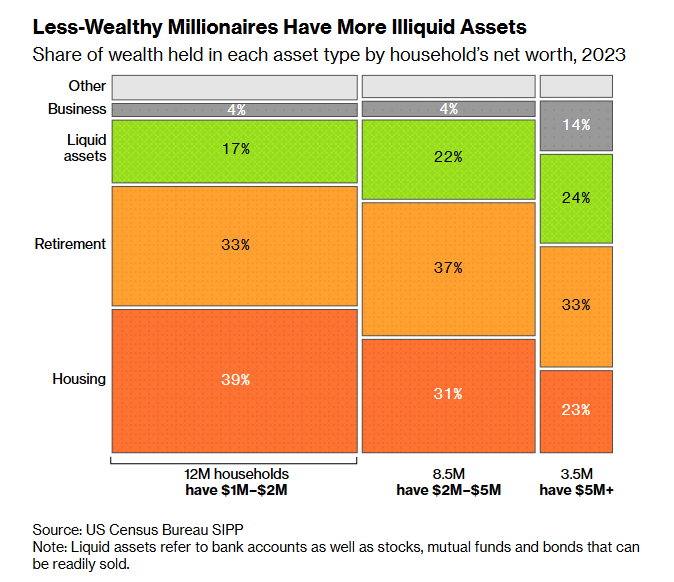

Less-wealthy millionaires hold most of their net worth in housing and retirement accounts, with far less in liquid, accessible assets.

The chart above shows that households with $1–$2 million in net worth hold nearly 40% in housing and 33% in retirement accounts, leaving just 17% in liquid assets.

And even among higher-net-worth families, the tilt toward illiquid investments and private markets has increased.

Housing Wealth Has Exploded

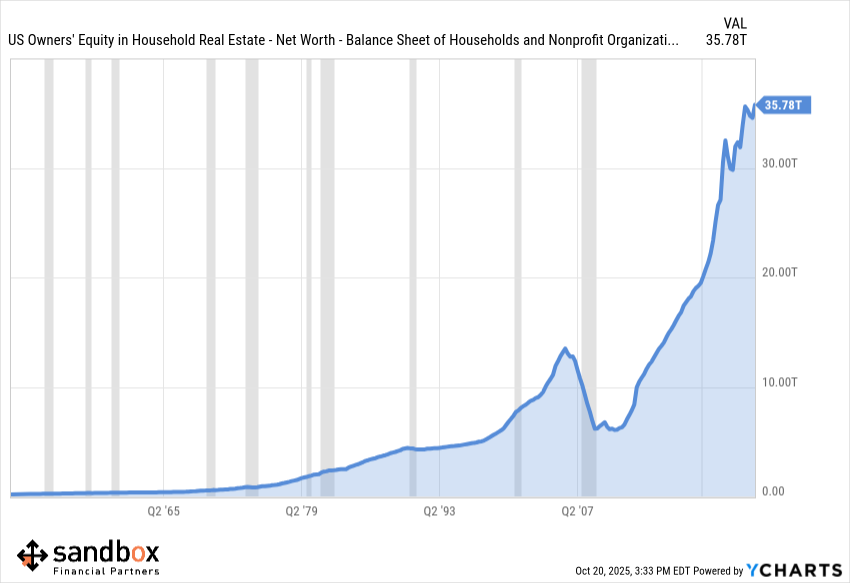

U.S. home equity has surged from roughly $19.5 trillion in 2019 to over $35 trillion today. This has created millions of new millionaires who might not feel very rich.

That’s because housing, while a critical asset, is expensive to access. Refinancing, selling, or downsizing introduces friction and taxes and most people don’t want to liquidate the roof over their head.

In other words, real estate creates wealth — but NOT flexibility.

A Financial Planner’s View: Turning Paper Wealth Into Real Flexibility

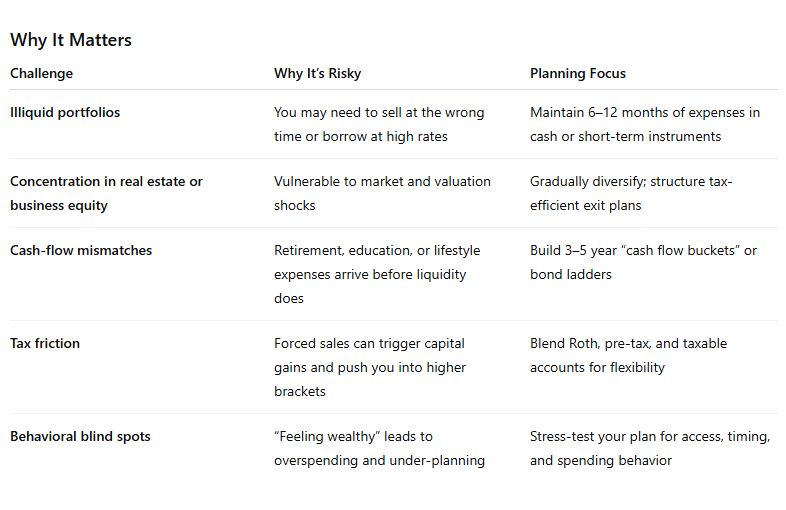

Build a Liquidity Buffer

Liquidity is not lost return. It’s insurance for opportunity. Keep cash to the tune of 3-to-6 months, or maybe even a year’s worth of living expenses in savings, money markets, or short-term Treasuries.Diversify by Liquidity, Not Just by Asset Class

A portfolio of real estate, business ownership, and retirement funds may look diversified but offer zero flexibility. Balance with taxable accounts, brokerage assets, or credit lines that can bridge gaps.Stress-Test for “Access Risk”

Ask yourself: What happens if I need $250K next year?Can it be raised efficiently, without disrupting long-term plans?

A good financial plan models those scenarios before they’re real.

Blend Tax Buckets

Roth, pre-tax, and taxable accounts each behave differently under market and tax cycles. Blending these gives you choices, which is the cornerstone of financial control.Manage Lifestyle Creep

Many new millionaires expand spending faster than liquidity. Anchor to core goals — retirement readiness, education, travel, giving — and let the rest flex.Treat Home Equity Strategically, Not Emotionally

Your home isn’t an ATM, but it is part of your balance sheet. Consider whether tapping equity through a downsize, rental conversion, or reverse strategy aligns with your long-term cash-flow plan.

A Simple Illustration

Household A: $4M net worth

• $2M in a home

• $1.5M in a private business

• $500K in retirement accounts

Household B: $3M net worth

• Broadly diversified across stocks, bonds, and cash

• Tax-diversified mix of Roth, pre-tax, and taxable assets

Household A looks wealthier but B has more flexibility. When opportunity or volatility strikes, liquidity wins.

The Bigger Picture: Wealth Is Becoming More Concentrated

Over time, wealth has become increasingly concentrated in the hands of the top 1% — who now hold roughly 31% of total household wealth, nearly equal to what the bottom 90% collectively own.

This concentration amplifies the liquidity divide:

The top 1% often have both the assets and the access — multiple liquidity channels, credit capacity, and professional planning.

The bottom 90% (which includes many of today’s new millionaires) often have the assets but not the structure — with wealth trapped in homes and tax-deferred accounts.

Financial planning becomes the great equalizer — the difference between being wealthy and being financially independent.

The Takeaway

Financial freedom isn’t just about how much you have, it’s about how easily you can use it.

Build liquidity into your plan.

Stress-test your portfolio for access and timing.

Balance growth, flexibility, and tax efficiency.

At Sandbox, we often remind our clients:

“Live More, Worry Less.”

Because true freedom isn’t about how much you own — it’s about how confidently you can use it.