Investors’ Greatest Risk: Themselves

How emotions quietly erode returns and what to do about it

The Hidden Cost of Emotion

The biggest threat to your portfolio isn’t the market… it’s your behavior as an investor.

If you’ve ever looked at an index or a fund’s “10-year return” and noticed that your own results came up short, you’re not alone. The reason often isn’t fees or bad fund selection — it’s timing and emotion.

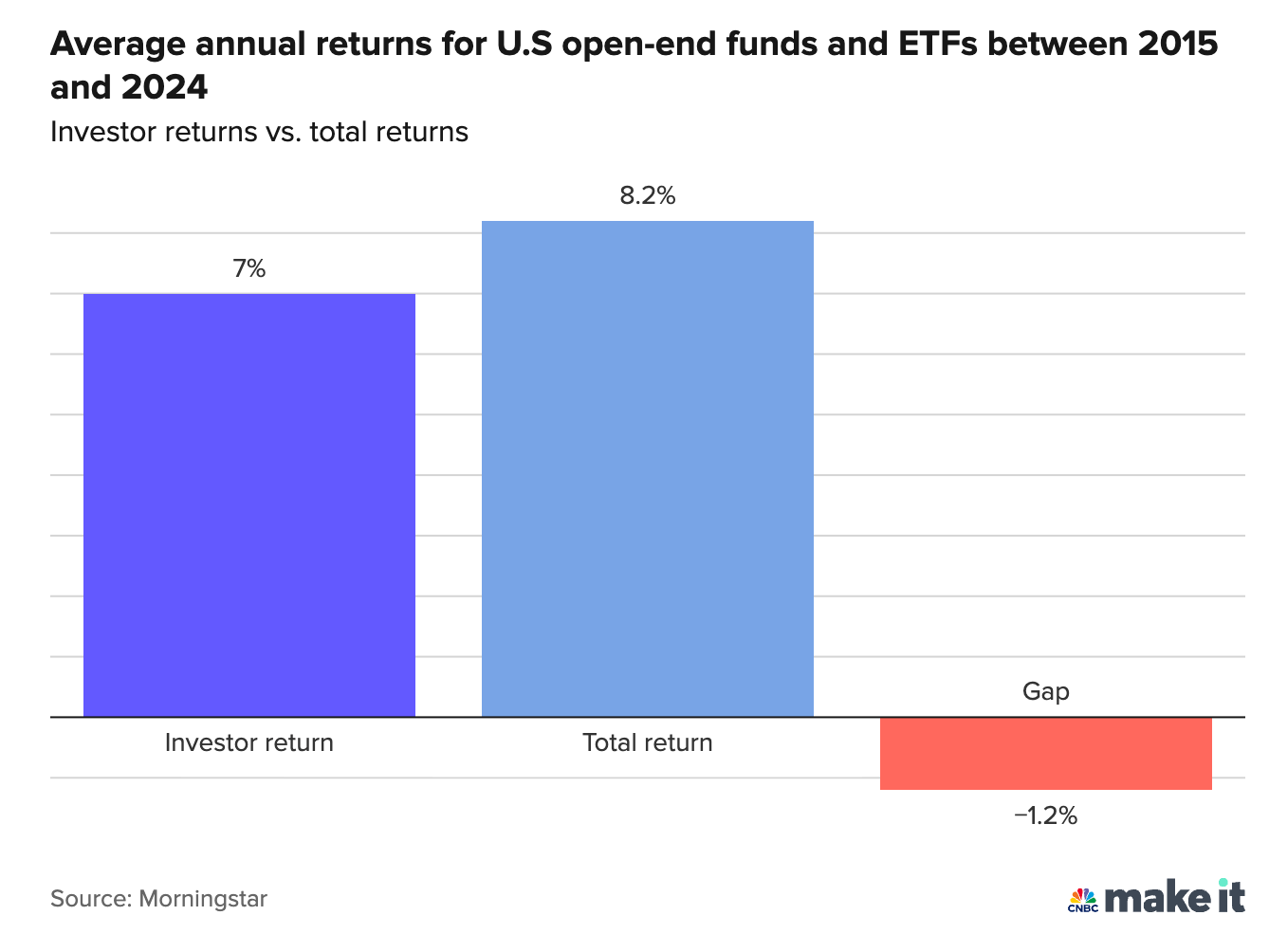

Morningstar’s 2025 Mind the Gap study found that while U.S. investment funds earned an 8.2% annualized return over the past decade, the average investor results were less. That 1.2% annualized gap may sound small, but it compounds to a 15% shortfall in total gains simply from buying and selling at the wrong times.

This is what’s known as the behavior gap — the space between what investments earn and what investors actually earn.

Why We Buy High and Sell Low

When markets rise, we chase (buy).

When markets fall, we flee (sell).

It’s human nature — but it’s also one of the most consistent destroyers of wealth. Even small timing mistakes, like investing right before a pullback or pulling out right before a rebound, quietly chip away at long-term results.

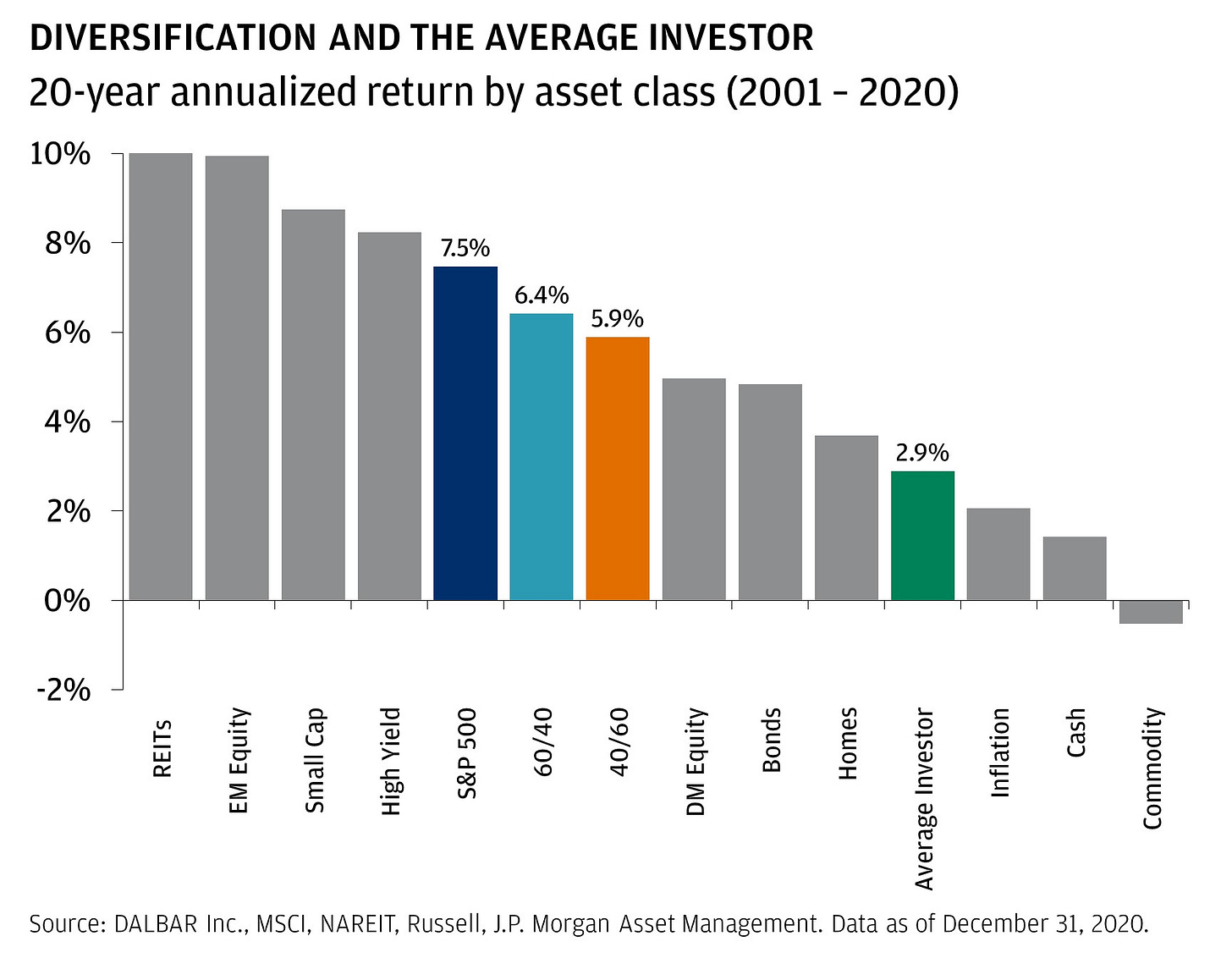

DALBAR’s long-term study of investor performance shows that over the past two decades, the average investor earned just 2.9% per year, while a simple 60/40 portfolio earned nearly 6%.

In other words, the market isn’t broken — our behavior is.

The more volatile an investment, the harder it becomes to stay the course. And the harder it is to stay invested, the less return you capture.

Patience Pays

Interestingly, the investors who did least performed best. I often joke that you should setup your 401(k), lose your login and you’re future self will thank you. You’ll sleep better and your balance will likely be larger than if you checked it routinely.

Morningstar found that target-date and balanced allocation funds — which investors tend to leave untouched in retirement accounts — showed virtually no behavior gap. Why? Because people didn’t tinker.

The takeaway is clear:

Consistency beats cleverness.

Automation, diversification, and disciplined rebalancing work far better than reaction and prediction. Or as Morningstar’s Jeffrey Ptak put it:

“Less is more. The less transacting you have to do, the better off you’re going to be.”

How to Close Your Personal Behavior Gap

You don’t need perfect timing to win at investing — just fewer emotional decisions.

Here’s how to start:

Know your plan.

When you understand why you own something, you’re less likely to panic when it fluctuates.

Match risk to temperament.

It’s better to earn a steady 6% you can stick with than chase a volatile 10% you can’t.

Automate contributions.

Dollar-cost averaging takes emotion out of investing.

Pause before acting.

Most financial decisions don’t need to be made in real time — sleep on it.

Even improving your behavior by a single percentage point can mean hundreds of thousands more over an investing lifetime.

The Bottom Line

You don’t need to beat the market to build wealth.

You just need to avoid beating yourself.

At Sandbox Financial Partners, we help clients design disciplined, personalized plans that balance risk, return, and behavior so their money works harder while they Live More and Worry Less.

Want to see what your personalized plan might look like?

Reach out to our team to start a simple conversation about your goals and where you stand today. Start the Conversation and Contact Us.