How Much Should You Save for Retirement?

Start with the Goal, Not the Guesswork

Most people ask, “How much should I save so that I can retire?”

The better question: “What kind of life do I want to live?”

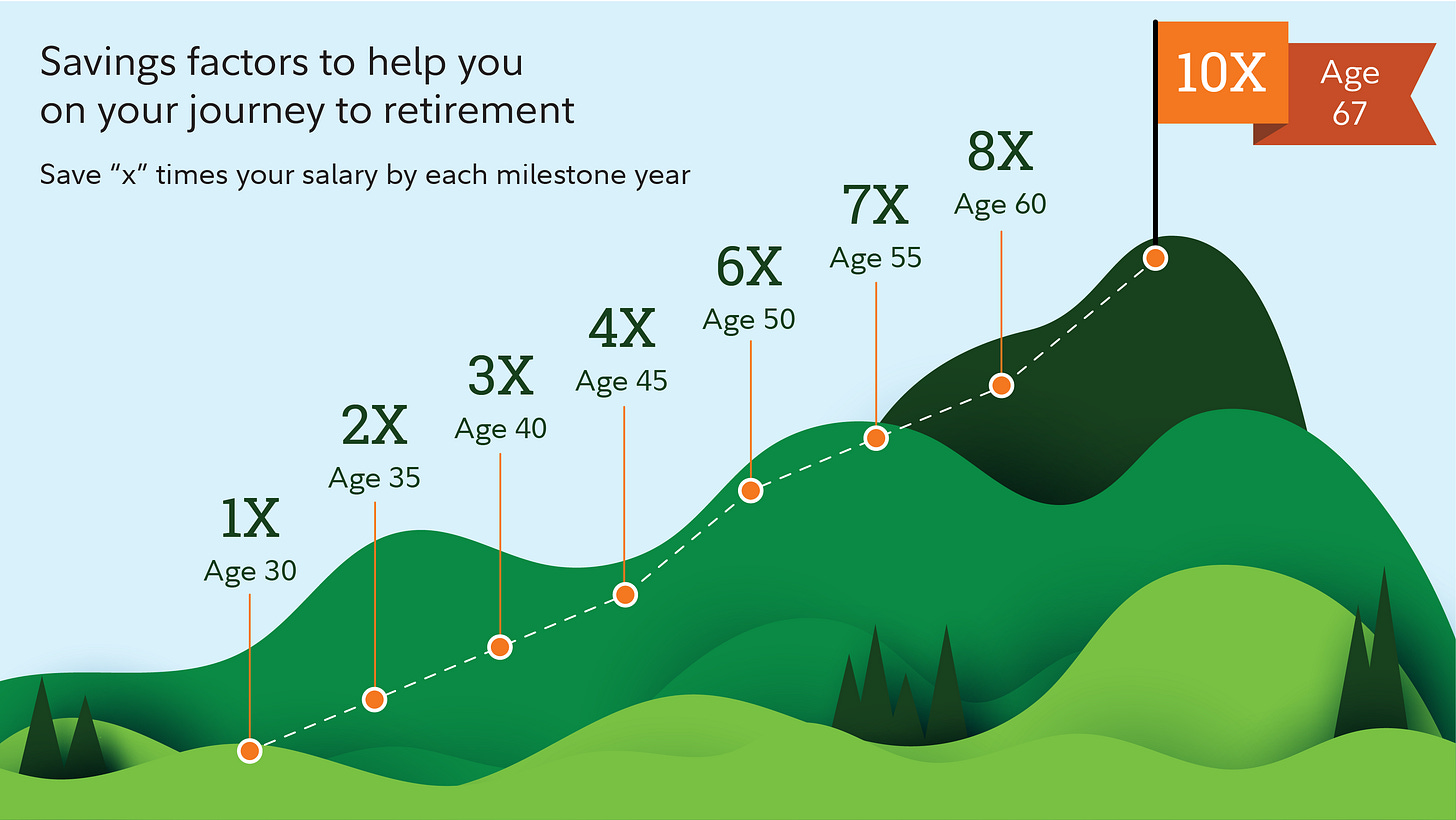

That’s one of the most common and stressful questions people ask. Fidelity (and other financial firms) often provide simple rule of thumbs, for example:

Save 1x your salary by age 30,

Save 3x by 40

Save 6x by 50

Save 8x by 60

Save 10x by 67

These benchmarks can be helpful. They give you a quick pulse check and a way to see whether you’re roughly on track. But in our experience working with families across different income levels and life stages, those formulas only tell part of the story.

A more effective approach starts with your financial and retirement goals, not the generic guideline.

The Math Behind It

Let’s say you start saving 10% of your income at age 30 and earn an average 7% annual return over time.

If you make $100,000 per year, that’s $10,000 saved each year (not including any employer match, bonus or salary increases).

Here’s how compounding growth can work in your favor:

After 10 years (age 40), your savings could grow to roughly $138,000.

After 20 years (age 50), that balance could climb to about $409,000.

After 30 years (age 60), your portfolio could reach around $922,000.

After 40 years (age 70), those steady contributions could compound to over $2 million.

That’s the power of time and consistency — even starting at age 30, a disciplined 10% savings rate and long-term investing mindset can get you well beyond the 10× goal by retirement.

Reverse Engineering Your Retirement Number

Instead of starting with “How much should I have saved by now?”

Flip the question: What kind of retirement do you want?

Your vision and cost to “live your life” will drive the math.

Do you want to travel, help your children or grandkids financially, or maintain the same lifestyle you have now? Or are you planning to downsize, spend more time at home, and live a simpler life?

Once that goal is defined, we can back into the numbers, estimating how much annual income you’ll need to support your vision and how much you should be saving now to get there.

This approach is more personalized and less anxiety-inducing than chasing a moving target like “10x your income.” It allows your savings strategy to adapt to your career, lifestyle, and family priorities, not the other way around.

The Two Levers That Matter Most

While everyone’s plan is unique, two variables play an outsized role:

1. When you plan to retire

The longer you work (and delay withdrawals), the less you need saved upfront. Retiring at 70 versus 65 can make a major difference, thanks to compounding, fewer years of drawdown, and larger Social Security benefits.

2. How you want to live

If your goal is to maintain your current lifestyle, a 10x multiple might make sense.

If you expect to downsize or reduce spending, closer to 8x may be sufficient.

If you plan to travel, give more, or support family, 12x or more could be realistic.

These are starting points, not ultimatums. The real number depends on your cash flow, investment strategy, tax planning, and goals.

What If You’re Behind?

Most people are, or at least they feel that way, and that’s okay.

If you’re under 40, the best step is to start saving more and invest for growth.

If you’re over 40, the focus often shifts to increasing savings, reducing spending, and extending your working years, even by a few years, which can have a huge impact.

At Sandbox, we emphasize that retirement planning isn’t about perfection; it’s about direction. If your “financial foundation is sound” and you’re saving with intention, reviewing your plan annually, and adjusting as life evolves, you’re already ahead of most people.

The Sandbox Mindset

We prefer to think of retirement planning as a life planning exercise, not a math equation. Our job is to help you build a roadmap that supports both your current lifestyle and your future independence, without guilt, comparison, or unrealistic expectations.

Read: Three Foundational Financial Planning Tools for Sandbox Clients

And remember, you can borrow to pay for college, but you can’t borrow money (or time) for retirement. And no matter where you stand today, it’s never too early or too late to take action.

Want to see what your personalized plan might look like?

Reach out to our team to start a simple conversation about your goals and where you stand today. Start the Conversation and Contact Us.