Highs beget Highs 📈

So just keeping buying

The phrase "highs beget highs" is a common saying in finance, particularly when referring to stock markets. It suggests that when an index or asset reaches a new record high, it's more likely to continue setting new highs in the future, rather than experiencing a significant pullback. This idea is based on the observation that positive price momentum often attracts further buying interest, potentially pushing prices even higher.

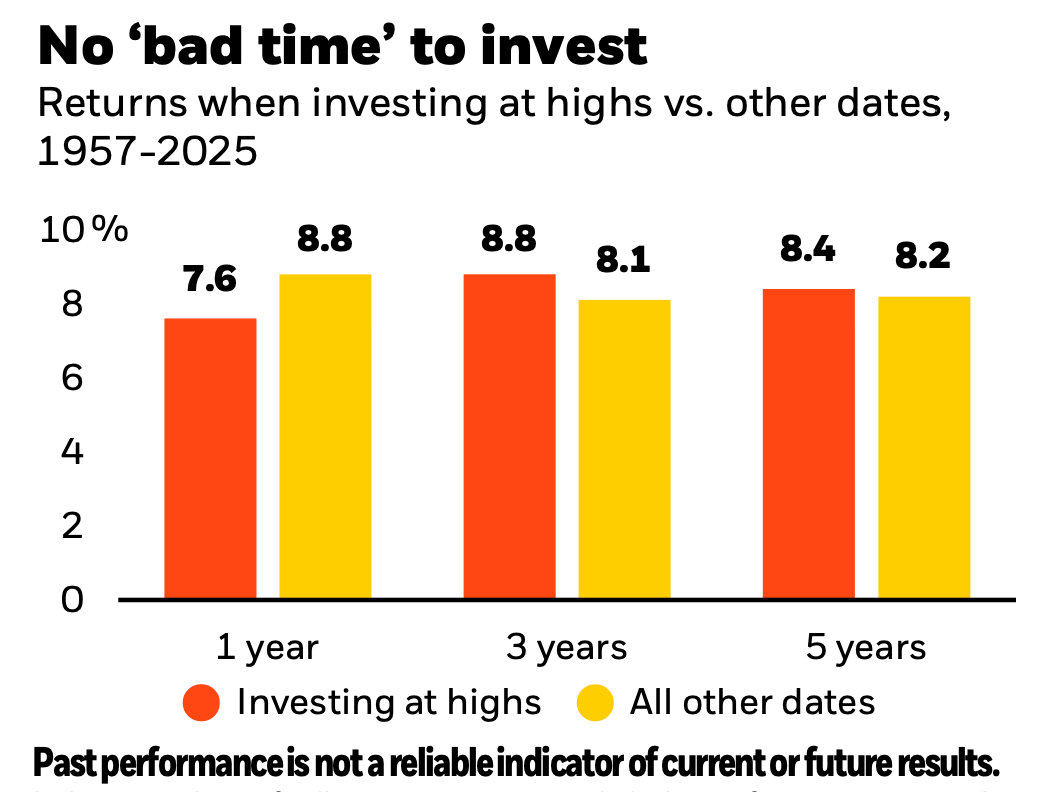

No ‘Bad Time’ to Invest, So Just Keep Buying

“Ultimately, there is no ‘right’ time to enter the markets, and attempts at timing entries and exits are generally less fruitful than staying the course, particularly when fundamentals are solid, as we believe they are today.

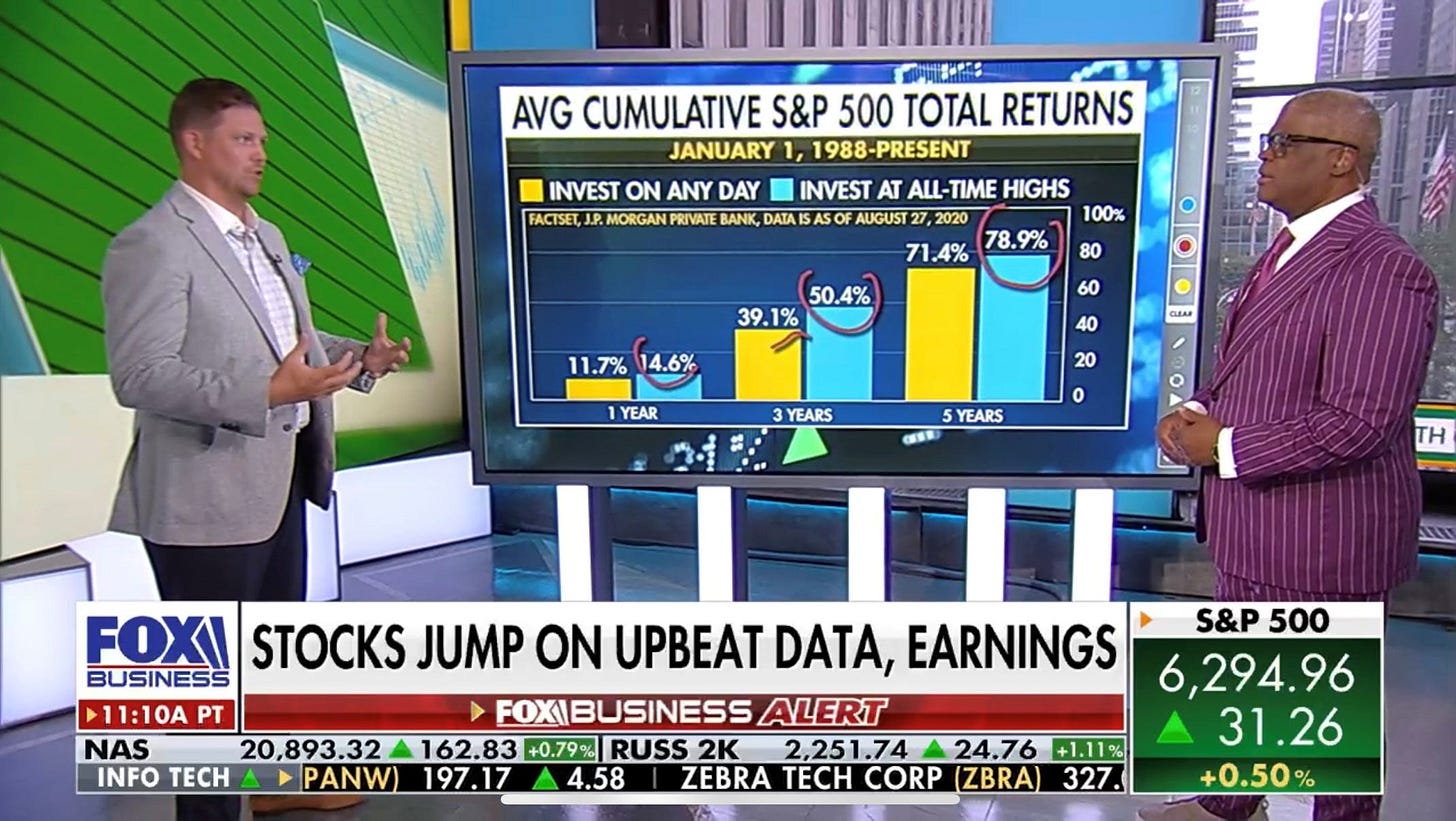

History shows buying at recent highs does little to affect subsequent one-, three- and five-year outcomes, as shown in the chart.

In fact, ‘new highs’ are a regular feature of the market, with the S&P 500 Index making an average of 18 new highs per year since its inception in 1957.”

How often does a big correction follow a market high?

For long-term investors who are skeptical about investing in this environment, it may be helpful to know just how rare market corrections from all-time highs have been.

The charts below show how often the S&P 500 Index has finished down greater than 10% over various periods of time, following each of the 1,250+ all-time highs since 1950.

Looking out just one year from each all-time high in the S&P 500, market corrections greater than 10% have occurred only 9% of the time.

As we extend the time horizon, market corrections become even rarer. In fact, the S&P 500 has never been down by more than 10% at the end of a 10-year period following any of its all-time highs since 1950.

Long-term investors have the advantage of an extended time horizon. Staying invested can help them stick to their financial plan.

The Takeaway:

New highs aren’t a warning sign, they’re a normal, healthy and part of long-term market growth. History shows that buying at or near all-time highs has rarely hurt investors with a multi-year horizon, and in many cases, has led to continued gains.

Corrections from these levels are uncommon, and over longer periods, virtually nonexistent.

The lesson is clear: focus on time in the market, not timing the market.

Consistent investing, especially when fundamentals are strong, remains one of the most reliable paths to building wealth.