Bitcoin’s Big Moment

BTC surge is real but your strategy should stay grounded

One of the hardest parts of investing is balancing long-term goals with short-term headlines. And that challenge doesn’t go away when markets are rising, it just changes shape.

Lately, there’s been growing excitement around Bitcoin as it surges to new all-time highs, fueled by rising investor interest and a flurry of activity in Washington during what’s being dubbed “Crypto Week.” Congress is weighing new regulations, including a framework for stablecoins, general crypto oversight, and efforts to block the creation of a government-backed digital currency (CBDC).

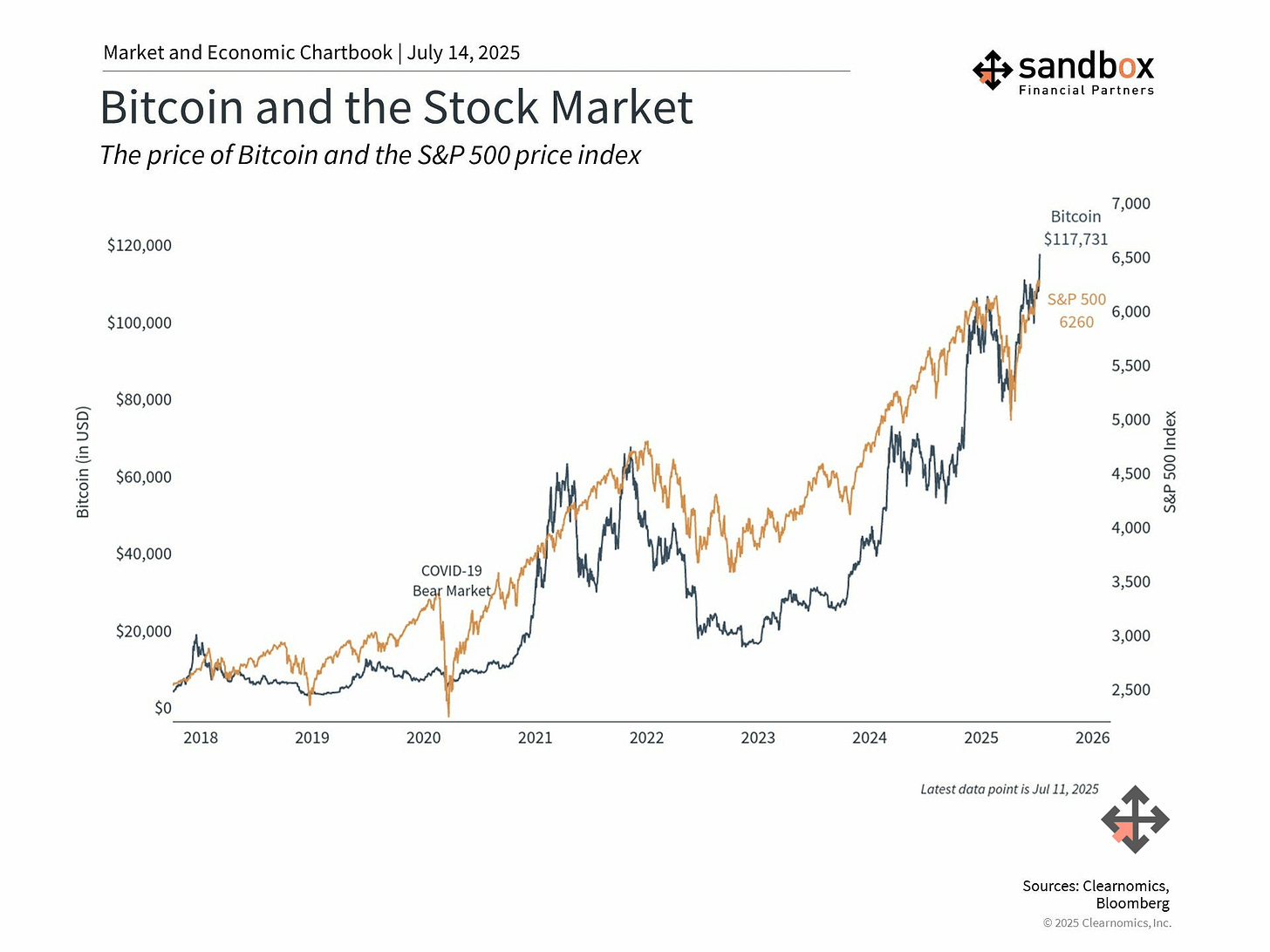

Bitcoin continues to capture attention with eye-popping returns: up 156% in 2023 and another 121% in 2024 — compared to back-to-back 20% gains for the S&P 500. But it’s not all upside: during the 2022 bear market, Bitcoin dropped over -75%, while the S&P 500 declined closer to -25%.

That kind of volatility is why Bitcoin can amplify both the upside and downside risk in a portfolio.

Should long-term investors be paying attention?

Absolutely.

But does that mean reacting to every crypto headline or chasing momentum? Not necessarily.

As with any investment or asset, it comes down to fit. How does it align with your goals, your risk tolerance, and your time horizon?

Bitcoin (and crypto in general) may play a complementary role in a well-diversified portfolio, but it’s no substitute for a plan grounded in time-tested asset classes like stocks, bonds, real estate, etc.

The real question isn’t whether your portfolio includes the trend of the moment. It’s whether it’s helping you build toward what matters most: buying a home, funding retirement, or securing your family’s future.

As always, our focus remains on building investment portfolios designed to weather both excitement and uncertainty that fit your long-term financial plan.

Want to discuss Bitcoin and Cryptocurrency in more detail, contact us for a chat.