🎢 April's Roller Coaster: Why Volatility Was a Win for Your 401(k)

How April 2025 rewarded retirement savers who stayed the course

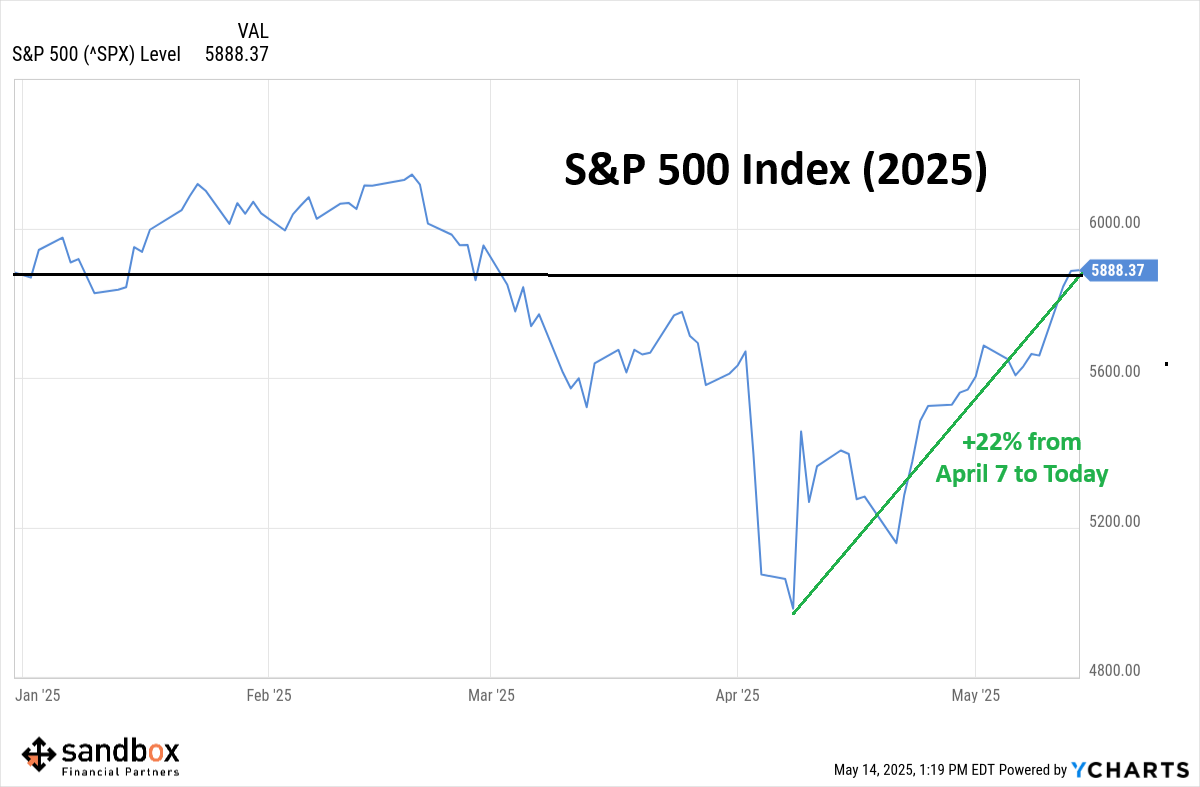

April 2025 felt like a market mess. Inflation concerns, rising interest rate fears, and trade tensions rattled investor confidence. News headlines were loud. Volatility was back. And for many, it triggered that familiar sinking feeling: Should I be doing something different with my investments?

If you're contributing to a 401(k) or saving for retirement with each paycheck—here’s the good news: April was actually a gift.

💥 The Drop: What Happened in April 2025

Markets opened the month with a thud. On April 2, broad-based tariffs were announced by the U.S. administration. Markets reacted swiftly:

The S&P 500 fell 6.65% in a single day (April 3)

The Dow Jones dropped nearly 4%

Over two days, major indexes tumbled close to 10%

That was one of the sharpest short-term selloffs we’ve seen in years. But just a few days later, things reversed.

By April 9, after a pause on the tariff rollout and easing inflation data:

The S&P 500 surged 9.5% in a single session — the biggest one-day gain since WWII

By mid-May, year-to-date losses were erased

Investors who didn’t flinch were made whole—and then some

💡 The Advantage for Retirement Savers

Here’s where the real opportunity was: If you were contributing to your 401(k) on autopilot during April’s volatility, you bought more shares when prices were lower.

Let’s break this down:

You didn’t have to time the market. Your contributions did the heavy lifting for you.

You bought at a discount. Market dips meant each paycheck went further, you bought the sale.

You gained more when the rebound hit. Those extra shares bought at a discount surged in value just days later.

That’s the power of dollar-cost averaging: regular investing means you’re taking advantage of volatility, not getting hurt by it.

🧠 Why Removing Emotion is Your Superpower

The real danger wasn’t April’s volatility—it was the temptation to act on it.

Market headlines can stir fear, but fear is expensive. The investors who panicked and paused their contributions—or worse, pulled money out—missed one of the best rebound weeks in recent memory.

Those who stayed invested and kept contributing? They came out ahead.

🚀 What This Means for Your Retirement Plan

If you:

Automatically contribute to your 401(k) every two weeks (or each paycheck)

Ignore short-term market noise

Stick to a plan based on long-term goals

Then April wasn’t a setback. It was a discount shopping spree for your future.

This is why emotional discipline matters more than market predictions. When you take your feelings out of the process and stay consistent, the math works in your favor.

✅ Bottom Line

April 2025 was extremely chaotic but for retirement savers:

The market dropped fast — and bounced even faster (“V” shaped )

Regular 401(k) contributions scooped up investments at a discount

Staying the course turned volatility into long-term value

Sometimes the best move is to do nothing but is another example of staying committed to your plan.

Keep contributing. Stay grounded. Let time and discipline do the rest.