AI Data Centers Are Driving Electricity Prices Higher

What it means for households, businesses, and investors

A Quick Summary

This post is based on a recent Bloomberg analysis of how AI data centers are reshaping U.S. electricity markets. You can read the full article here: Bloomberg – AI Data Centers Are Sending Power Bills Soaring.

We’ve summarized the key takeaways for Sandbox Pulse readers: what’s happening, why it matters, and what to watch next.

The Big Picture

Artificial intelligence isn’t just transforming industries, it’s transforming our power grid. The massive computing needs of AI data centers are driving electricity demand at a pace the U.S. hasn’t seen in decades. And that demand is showing up in your power bill.

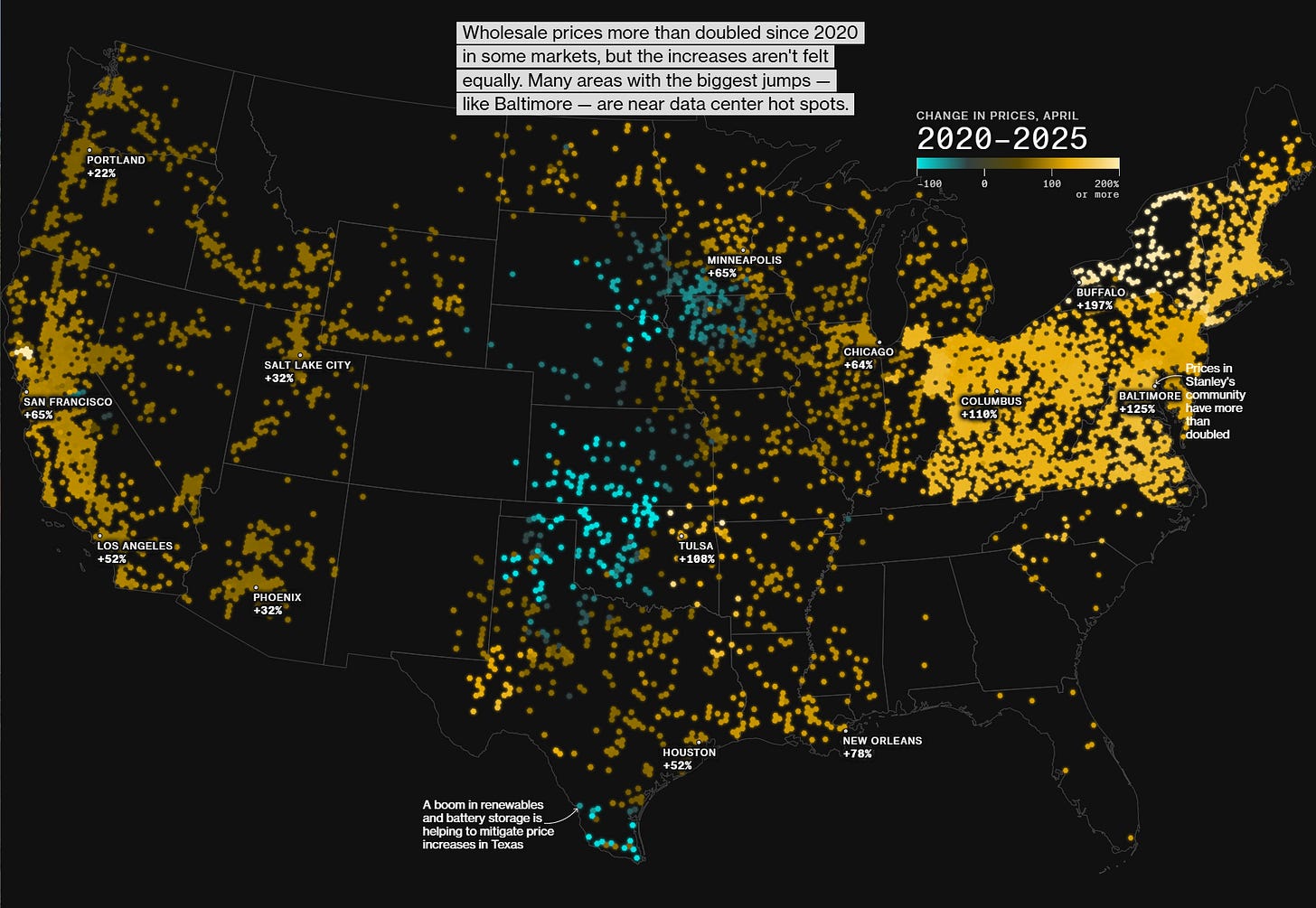

Since 2020, wholesale electricity prices near major data center hubs have more than doubled, with some areas seeing increases of 200%+.

The cost burden doesn’t stop at the data centers. Local households and businesses often pay higher rates as capacity costs and generation constraints ripple through the grid.

By the Numbers

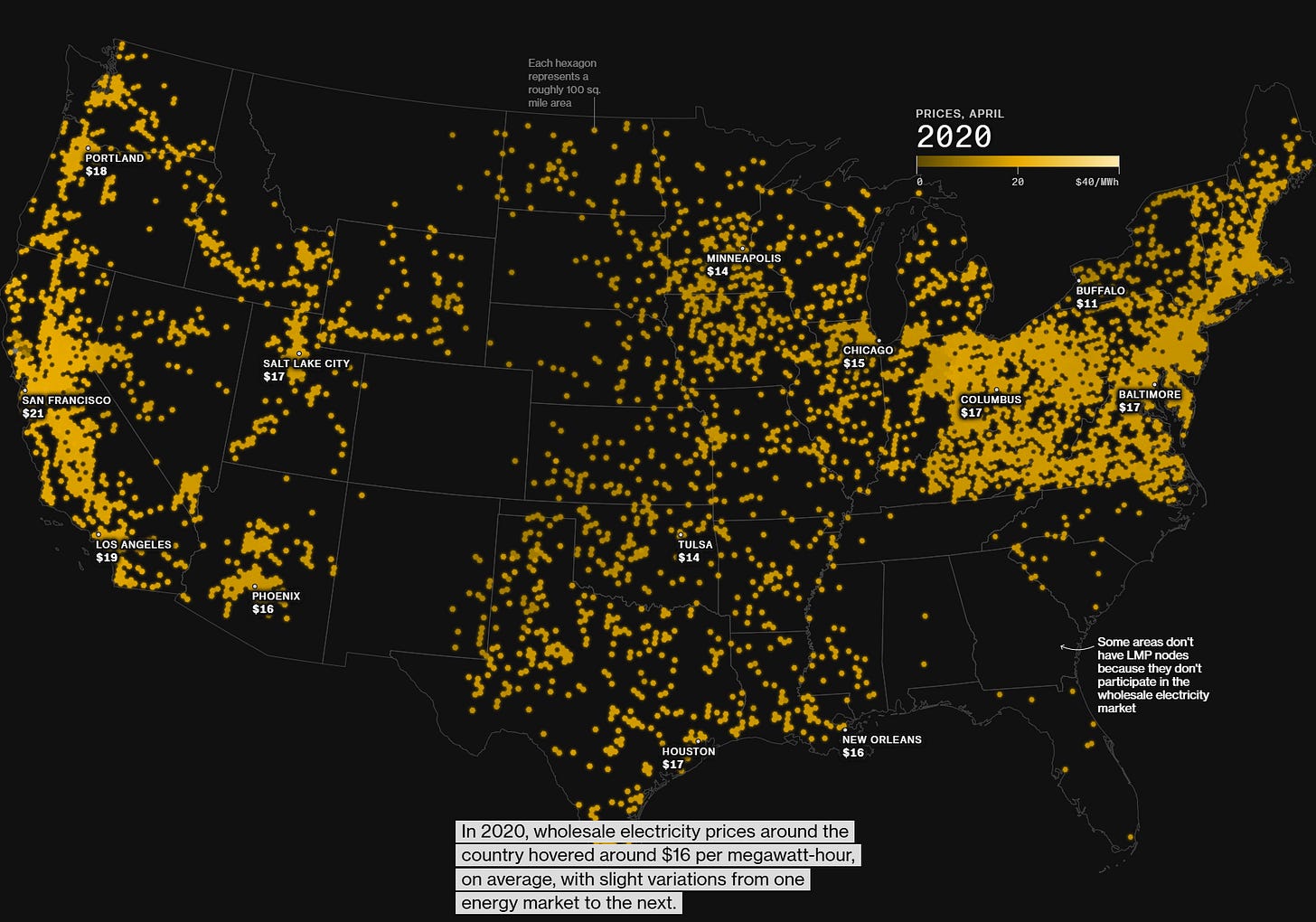

📊 2020 Baseline

Wholesale prices averaged $16 per megawatt-hour nationwide, with only slight regional variation.

📊 2020–2025 Change

From 2020 to 2025, wholesale prices more than doubled in regions clustered with AI data centers.

Baltimore: +125%

Columbus: +110%

Buffalo: +197%

Tulsa: +108%

San Francisco: +65%

Los Angeles: +52%

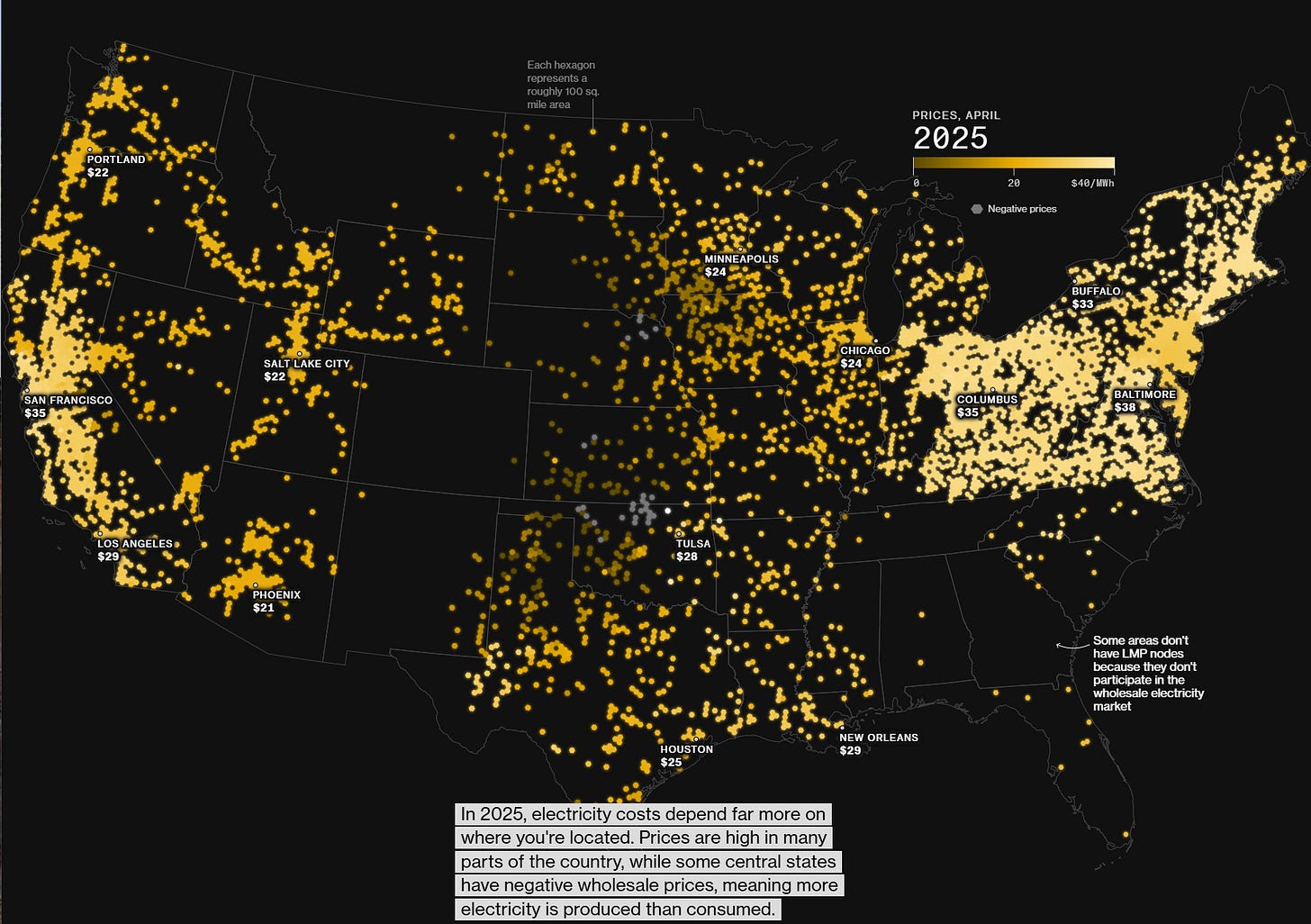

📊 2025 Reality

By 2025, regional disparities are sharp. Baltimore at $38/MWh versus $21 in Phoenix, with some central states even seeing negative prices due to renewable oversupply.

Baltimore: $38/MWh

Columbus: $35/MWh

Buffalo: $33/MWh

San Francisco: $35/MWh

Los Angeles: $29/MWh

Why It’s Happening

AI Workloads: Training and running large models can consume 10–50x the energy of traditional data centers.

Clustering: Companies build near fiber optic backbones, cheap land, and favorable tax structures, concentrating demand.

Grid Bottlenecks: Transmission lines and new generation capacity take years to build, creating localized shortages.

Capacity Markets: In PJM (covering 65 million people), capacity auction prices recently jumped from $270 to $329 per megawatt-day—costs passed along to consumers.

The AI Data Center Build-Out

The Bloomberg maps show the price spikes, but here’s what’s behind them:

The U.S. added 6,900 MW of new data center capacity in 2024 alone, with another 6,300 MW under construction — more than double the prior year.

Hyperscale facilities are booming: there are now 1,100+ worldwide, and the U.S. accounts for more than half of total capacity.

By 2030, U.S. data centers could consume up to 9% of all U.S. electricity — triple today’s share.

McKinsey projects “AI-ready” data center capacity demand to rise 33% per year through 2030.

Deloitte forecasts that AI data centers could grow their power needs 30× by 2035, reaching over 120 GW of demand — roughly equal to powering 90 million U.S. homes.

What Comes Next

Demand Surge: Global data center electricity use is expected to double by 2030, hitting nearly 1,000 TWh.

Investment Race: Utilities, renewable developers, and storage providers are scrambling to keep pace.

Regional Winners & Losers: Texas, with abundant wind and solar, is absorbing growth more smoothly. The Mid-Atlantic and Midwest are seeing grid strains and sharp bill increases.

Why It Matters to You

For households and businesses: Expect more regional disparities in electricity costs.

For investors: Utilities, grid infrastructure, and renewables are at the center of this shift.

For policy and planning: The AI build-out is colliding with clean-energy transition goals, making grid investment one of the most pressing economic issues of the next decade.

💡 Takeaway: AI is powering innovation but it’s also powering up your electric bill. Watching where data centers are built could become just as important as watching where factories or housing developments go.

Sources & Credits

Original reporting: Bloomberg – AI Data Centers Are Sending Power Bills Soaring

Additional research: U.S. Department of Energy (LBNL), International Energy Agency (IEA), CBRE, McKinsey, Deloitte, Goldman Sachs, BNEF, SRG Research.

plus they are bad for our rights plus they are bad for our rights https://open.substack.com/pub/outlawedbyjp/p/a-dark-cloud-lingers-the-evil-youre?r=1jksj5&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false