5/29 Day: Start Saving for College Today

Early 529 Plan Contributions Can Make a Big Difference

🎓 Happy 5/29 Day: A Smart Reminder to Plan Ahead

May 29th, or “529 Day,” is the perfect opportunity to revisit one of the most powerful tools available for saving for education: the 529 plan. With the cost of college continuing to rise, the earlier you start, the better prepared you—and your future student—will be.

📈 The Soaring Cost of College

College expenses have been climbing at a pace far faster than inflation. For the 2024–2025 school year, the average total cost (including tuition, room, board, and other fees) is approximately:

$29,910/year for in-state public universities

$49,080/year for out-of-state students at public universities

$62,990/year at private nonprofit universities

If tuition continues to grow at around 6% per year, the total cost of a 4-year degree in 2035 could exceed $230,000 at a private college.

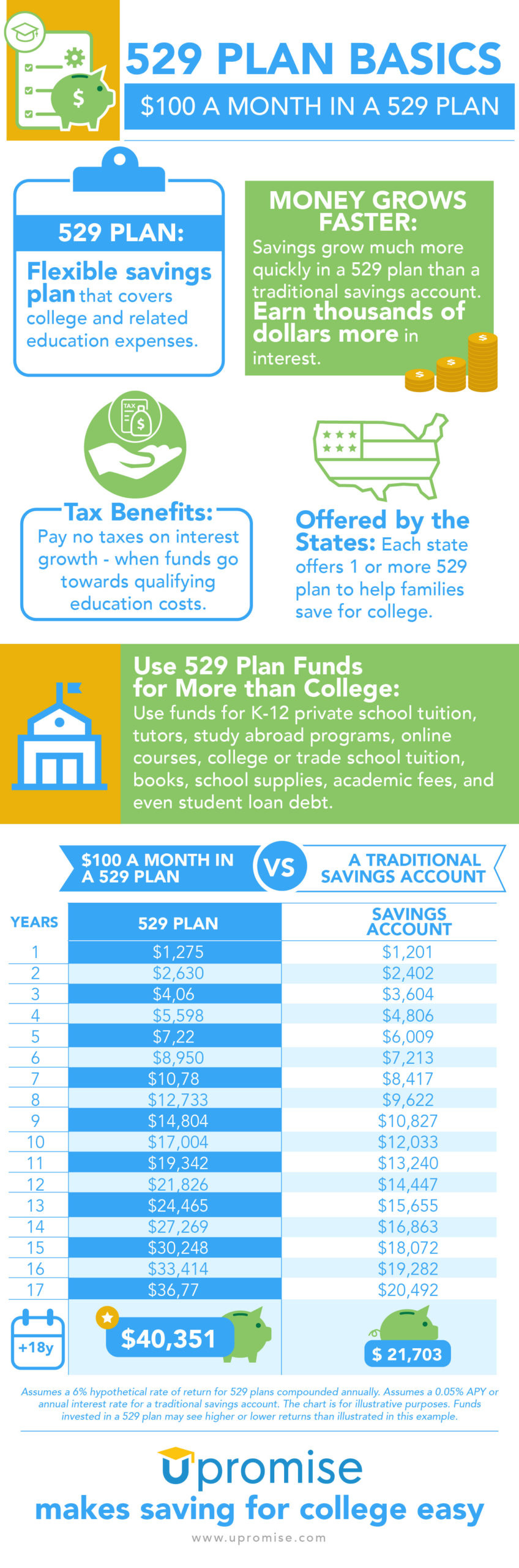

💡 Why Start Saving Early?

The earlier you start saving, the more you benefit from compounding returns. Here’s a quick example:

Start when your child is born, invest $250/month in a 529 plan

Assume a 6% average annual return

Over 18 years, you’ll have contributed $54,000, and the account could grow to ~$90,000

Wait until age 10 to start? That same $250/month gets you only ~$31,000 by college time.

That’s nearly 3x more by starting early — without changing your monthly contribution.

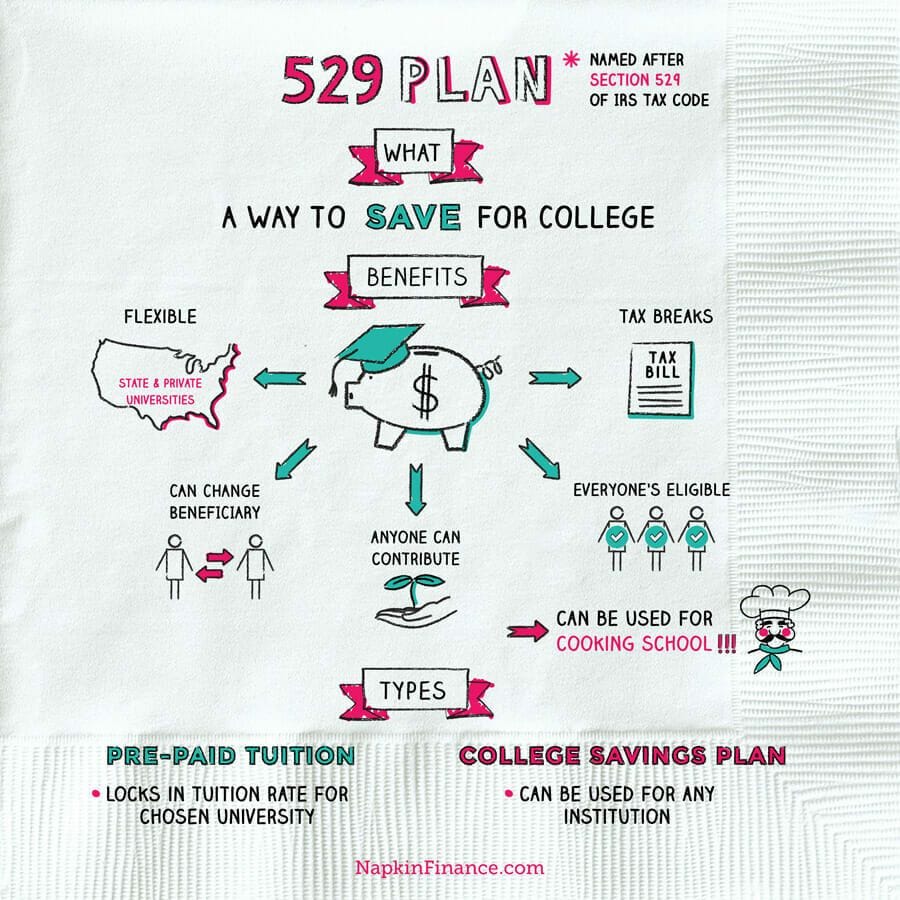

📘 What is a 529 Plan?

A 529 plan is a tax-advantaged investment account designed to help families save for education. Here’s why it’s such a great tool:

Tax-free growth: Earnings grow tax-free and aren’t taxed when used for qualified education expenses.

State tax benefits: Many states offer deductions or credits for contributions.

Flexibility: Funds can be used for tuition, room and board, books, and even K–12 or certain apprenticeship programs.

In Maryland, for example, the Maryland College Investment Plan provides additional benefits to residents.

💰 The Power of a Lump Sum

If you’re in a position to make a lump sum contribution early on, the benefits compound even faster. For example:

Contribute $50,000 when your child is born

At a 6% return, that could grow to over $143,000 by age 18

This strategy offers a strong head start and can reduce the pressure of monthly saving.

🎯 Final Thoughts: Start Where You Are

You don’t need to save the full cost of college to make a meaningful difference. Whether it’s $50/month or $5,000 today, starting something is better than nothing.

The key is simple: start early, stay consistent, and take advantage of the tax benefits a 529 plan offers.

Your future self—and your future college student—will thank you.

Need help starting a 529 plan or building a college savings strategy? Let’s talk.