10 Days That Made (or Broke) 2025

Why market timing keeps failing investors

2025 delivered a reminder that investors have seen many times before but still struggle to internalize.

Just 10 trading days made the difference between a strong year and a painful one.

The 2025 reality

So far this year:

The S&P 500’s 10 best days contributed roughly +32% to returns

Miss those days, and the market wouldn’t be flat, it would be down about -12%

Same year. Same market.

Completely different outcome based solely on whether you were invested.

That’s not luck. That’s math.

And it’s exactly why market timing is so dangerous.

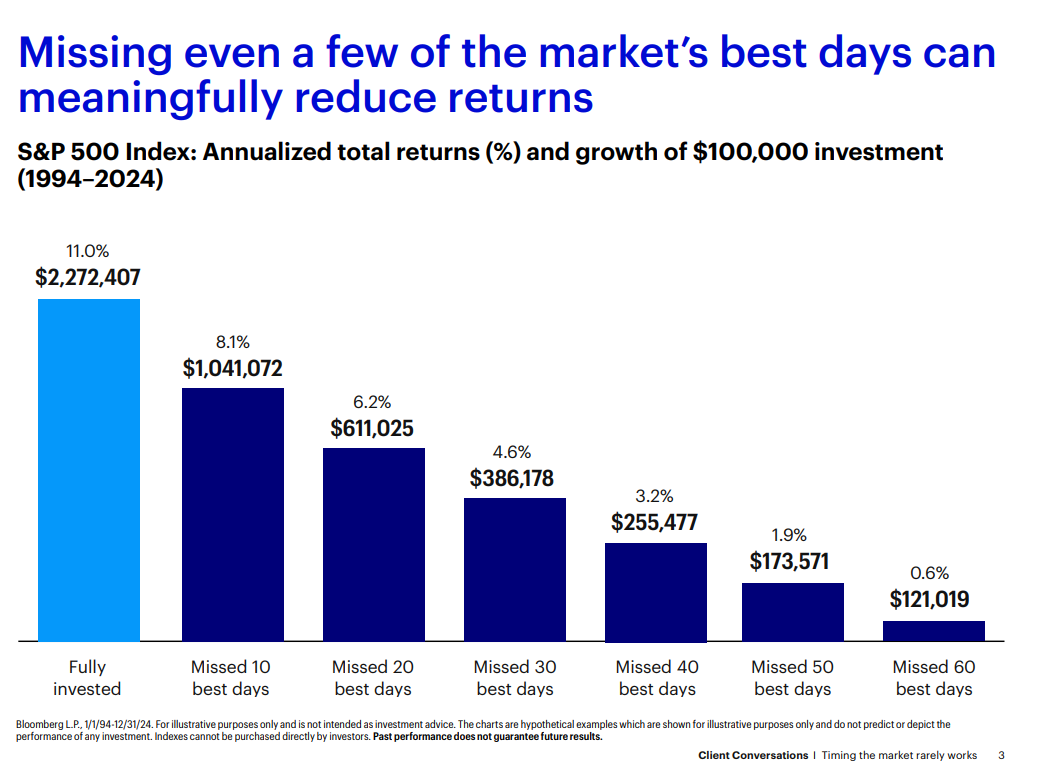

Now zoom out: 30 years of evidence

The chart below shows the impact of “trading” and missing the best days over time.

Over the past 30 years:

Stay fully invested: $100,000 grew to about $2.27 million

Miss the 10 best days: your gains were cut in half

Miss the 20–30 best days: compounding starts to break down

Miss the 60 best days: returns were barely positive

Think about that for a moment.

Missing a few dozen days — out of thousands of trading days — dramatically changes the outcome.

Why this keeps happening

Markets don’t move in a straight line. They zig and zag. They shock. They surprise.

The Roller Coaster of Emotional Investing illustrates that our own psychology works against us.

When markets drop:

Fear goes up

Confidence goes down

Many investors sell to “protect capital”

But here’s the catch: Some of the best market days show up right after the worst ones.

Sell at a low point and you’re very likely to miss the rebound.

This is not just theory.

It’s human behavior.

A fear-driven response can turn into a real, measurable loss of wealth.

The takeaway

2025 didn’t introduce a new lesson. It simply reinforced an old one.

You don’t need to guess the next move.

You don’t need to react to every headline.

Time in the market beats timing the market. Every time.

You need a plan that keeps you invested when it feels uncomfortable because that’s when the market’s most important days tend to happen.